IPO Results in 2020 and What Lies Ahead 2021 Funding Alternative for a Cash Constrained Industry

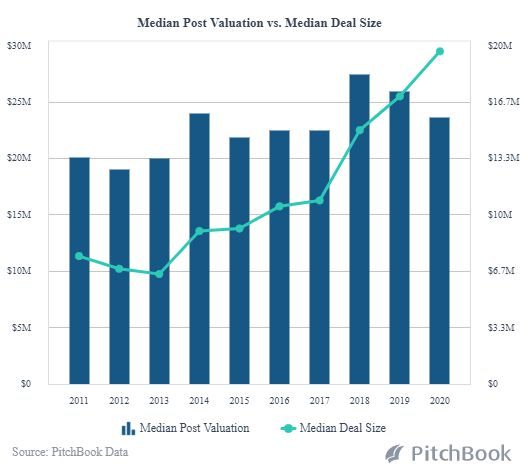

As the final statistics roll in for the infamous year 2020, PwC reports that IPOs will total as much as a projected $150B – the best year since the dot.com boom era. This total includes 183 traditional IPOs and a record 242 Special Purpose Acquisition Companies (SPACs). These SPACs account for raising over $80B; an increase, even in this pandemic year, of more than 460% over 2019. The 2020 IPO market was led by young technology companies and SPACs, with many companies in various industries actually delaying their IPOs simply because the market was too strong. Propelling the high expectations for the bulging slate of IPO candidates in 2021 is the sustained interest-rate policy of the Fed and the promise of the economy roaring back as the positive effects of the COVID-19 vaccine are realized.

What is coming in 2021? Market Watch reports 2021 to be the “Year of the SPAC” – with large companies in sectors like tech, for one, pursuing the traditional IPO route, while smaller companies turning to SPACs in order to go public.

Big Name Underwriters and Investors in SPACs

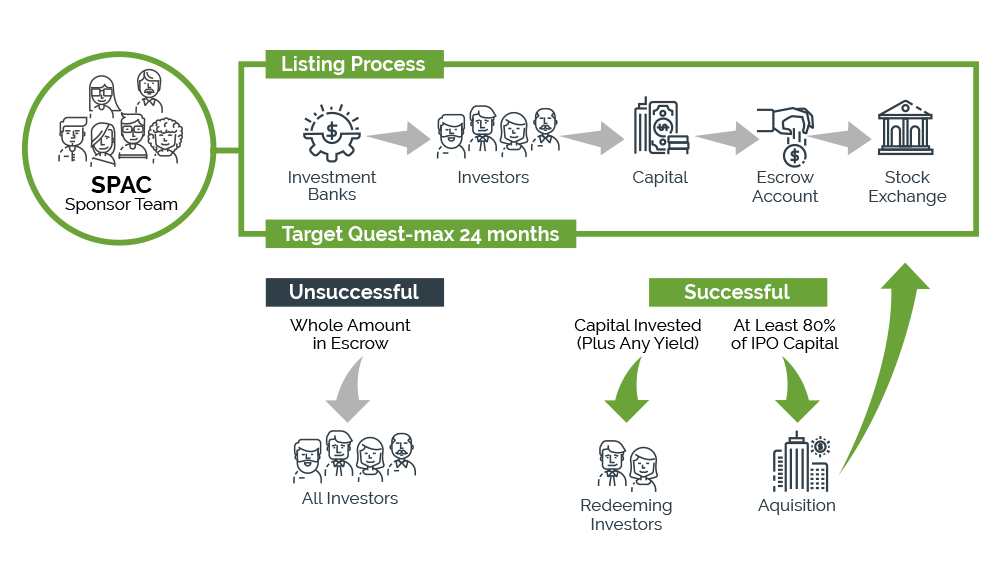

Although being around for decades as an alternative finance tool, SPACs, also called “blank check companies,” are formed to raise money through an IPO specifically to buy another company. Although at the time of an IPO filing a SPAC needs neither existing business operations, nor even a stated target for acquisition. By the end of two years the SPAC must complete an acquisition or return all funds to all investors. IPO investors, therefore, have no idea into which company their money will be invested, requiring confidence in an experienced management team or sponsor. SPACs engage underwriters and institutional investors before offering shares to the public. Funds cannot be disbursed except to complete a specific acquisition. And, after the acquisition the SPAC is commonly listed on a major stock exchange. Founding management team and sponsors typically invest in a 20% interest in the SPAC with the remaining 80% interest held by public shareholders of “units” of the IPO – a common share of stock along with a fraction of a warrant. All shares have similar voting rights.

Advantages of a SPAC

Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions, and receive what amounts to an expedited IPO process by an experienced acquisition management team.

Examples of High-Profile SPAC M&A Transactions

Some of the transactions often cited as prime examples of the success of the SPAC acquisition process are:

- Social Capital Hedosophia Holdings purchase of a 49% stake in Richard Branson’s Virgin Galactic for $800M in 2019

- This year, DraftKings, the digital sports entertainment and gaming company, merger in April with the SPAC Diamond Eagle Acquisition Corp

- The reverse merger by Fisker with Spartan Energy Acquisition Company in October

- Electric vehicle battery developer, QuantumScape, merger with Kensington Capital Acquisition SPAC in November

- And, the largest SPAC raise on record, $4B by Bill Ackman’s Pershing Square Tontine Holdings in July

The Significance of SPACs Funding Cannabis

2021 Funding Alternative for a Cash Constrained Industry

Statistics prepared by the leading cannabis industry research firm, BDA Analytics show U.S. cannabis sales to have reached $15B in 2019, and are still on pace to double in size to $30B as by 2024. 2021 is predicted to be a banner year as legalization nationally draws closer. If not the election of a presidential administration that campaigned on cannabis law reform, it is likely that passage of the SAFE Banking Act will be an aggressive step forward on a national basis. Coming out of COVID-19 all states are facing unfathomable revenue shortfalls and will be scrambling for more sources of tax revenue. This places renewed pressure on local jurisdictions to look to the revenue-generating/employment-creating potential of cannabis cultivation/ production/sales. New York, Connecticut, and Virginia are major medical marijuana markets that are most likely to move toward passage of adult use this year.

While this is the setting for the potential of cannabis in 2021, its national legal status continues to keep most VC, institutional investors and private equity money away from the industry. This puts the use of SPACs in the limelight for cannabis companies in the U.S. to access capital over traditional sources and in order to pursue the path of going public. 2021 Funding Alternative for a Cash Constrained Industry

While M&A in the cannabis industry has not quite lived up to pre-COVID expectations, 2021 is projected to be a banner year as more operators turn to SPAC sponsors for raising capital.

M&A Transactions Happening in Cannabis

Major players are now entering the industry through the SPAC route

- Credit Suisse & Citigroup led US IPOs for companies that invest in FDA-approved cannabis therapies and supporting technology for cannabis companies.

- JP Morgan and Goldman Sachs helped existing clients with cannabis-related deals.

And, the following are the dominant players in the industry that are rumored to have excess dry powder for potential M&A/SPAC investments in 2021

- Collective Growth $150M

- Greenrose Acquisition $150M

- Stable Road Acquisition Corp $170M

- Merida Merger Corp $120M

- Sliver Spike Acquisition Corp $250M

In addition, Marijuana Business Daily reports that Silver Spike Acquisitions and Subversive Capital Acquisitions recently announced deals worth more than $2B that are due to close in the first half of 2021. With two pending deals Silver Spike and Subversive Capital will create publicly traded companies with a combined total of $662 million in cash and public currencies. The objective of these SPACs is to acquire and consolidate smaller operators in California and do the same with marijuana-related technology companies. Subversive in 2020 merged Caliva and Left Coast with the Monagram brand and RocNation talent agency of rapper Jay-Z to form a vertically integrated cannabis operator in California with $185M in revenue. 2021 Funding Alternative for a Cash Constrained Industry

Investor TakeAway

In 2021, SPACs will represent a significant liquidity option for many diverse industries, having particularly promising potential in cannabis M&A transactions. In many cases the SPAC merger process with a target company can take place in a substantially shorter period of time than the traditional IPO timeline. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. This requires a strong, experienced management team with a sound business model. For instance, Silver Spike is taking public the California-based advertising platform for cannabis retailers, Weedmaps. This acquisition is a Nasdaq-traded, non-plant-touching, debt-free investment with a scalable, profitable advertising technology platform, and $160 million in revenue in 2020. Yet the question investors must carefully assess is how capable management is of accomplishing revenue growth to the level of the $400M projected to be achieved in 2023.

How We Can Help

As you can see in assessing the potential of a SPAC, due diligence is critical for understanding the technology in the industry being targeted, assessing the preemptive nature of the target’s business model, the soundness of the financial statements yet to be audited, and the experience of the team charged with the task of growing a company into a multimillion dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments. Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.