Trulieve Announces the Largest US Cannabis Transaction Combined Company Will Maintain Industry Leading Scale in Retail, Cultivation & Production

Footprint Provides National Scale with a Deep Regional Focus in Attractive Markets

Expanded Runway for Growth with new Southwest Hub and Expanded Northeast and Southeast Hubs

Combined Consensus 2021E Revenue of $1.2 Billion

Trulieve Announces the Largest US Cannabis Transaction Trulieve and Harvest to Host a Joint Conference Call and Webcast today at 8:30 a.m. ET

TALLAHASSEE, Fla. and PHOENIX, Ariz., May 10, 2021 /CNW/ – Trulieve Cannabis Corp. (“Trulieve” or the “Company“) (CSE: TRUL) (OTC: TCNNF) and Harvest Health & Recreation Inc. (“Harvest“) (CSE: HARV, OTCQX: HRVSF) are pleased to announce they have entered into a definitive arrangement agreement (the “Arrangement Agreement“) pursuant to which Trulieve will acquire all of the issued and outstanding subordinate voting shares, multiple voting shares and super voting shares (the “Harvest Shares“) of Harvest (the “Transaction“). Under the terms of the Arrangement Agreement, shareholders of Harvest (the “Harvest Shareholders“) will receive 0.1170 of a subordinate voting share of Trulieve (each whole share, a “Trulieve Share“) for each Harvest subordinate voting share (or equivalent) held (the “Exchange Ratio“), representing total consideration of approximately $2.1 billion based on the closing price of the Trulieve Shares on May 7, 2021.

Trulieve Announces the Largest US Cannabis Transaction Trulieve, a leading multi-state operator with a focus on the northeast and southeast regions of the United States, and Harvest, a leading multi-state operator with a focus on the west coast and northeast regions of the United States, have built deep, vertically integrated operations in their key markets, becoming leading operators in the United States, the world’s largest regulated cannabis market.

Upon completion of the Transaction, as well as the closing of other previously announced acquisitions by Harvest and Trulieve, the combined business will have operations in 11 states, comprised of 22 cultivation and processing facilities with a total capacity of 3.1 million square feet, and 126 dispensaries serving both the medical and adult-use recreational cannabis markets.

Key Transaction Highlights and Benefits

- Increases Scale Across Our Hub Markets – through the creation of the largest U.S. cannabis operator on a combined retail and cultivation footprint basis;

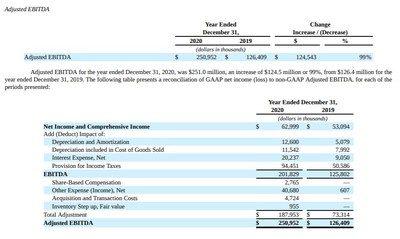

- Creates the Most Profitable US MSO – with combined 2020 Adjusted EBITDA of $266 million1,2 and combined 2021E consensus Adjusted EBITDA3 of $461 million, delivering an unparalleled platform for continued growth;

- Delivers a Superior Existing Retail and Distribution Model – from a robust retail network of 126 dispensaries across 11 states, the combined company will have leading market shares in Arizona and Florida;

- Strong and Expanding Multi-State Presence – bolsters Trulieve’s expansion in US northeast and southeast hubs in Florida, Pennsylvania and Maryland, and establishes a southwest hub in core markets including Arizona, where recreational adult use of cannabis was recently legalized;

- Optimizes Nationwide Presence – through well-established retail and wholesale channels across markets, as well as the ability to reach an estimated total addressable market of US$19.3 billion in 2025E (Arcview market estimate);

- Adds Premium Brands – to Trulieve’s portfolio of in-house brands and national brand partners with a successful line of products across multiple form factors;

- Leverages Expert Operating Teams and Best Practices – from each of Trulieve and Harvest, enhancing operational excellence by combining unparalleled knowledge of, and success in winning, state license application processes and the ability to rapidly bring operations to market; and

- Accretive Transaction Reinforces Trulieve’s Leading Financial Metrics – by reinforcing superior financial performance relative to peers through industry-leading margins and strong projected profitable growth.

Management Commentary

“Today’s announcement is the largest and most exciting acquisition so far in our industry, creating the most profitable public multi-state operator. Importantly, our companies share similar customer values with a focus on going deep in core markets. This combination offers us the opportunity to leverage our respective strong foundations and propel us forward with an unparalleled platform for future growth,” stated Kim Rivers, Chief Executive Officer of Trulieve. “Harvest provides us with an immediate and significant presence in new and established markets and accelerates our entry into the adult use space in Arizona. Trulieve and Harvest are leaders in our markets, recognized for our innovation, brands, and operational expertise with true depth and scale in our businesses. We look forward to providing best-in-class service to patients and customers on a broader national scale as we create an iconic US cannabis brand.”

“We are thrilled to be joining Trulieve, a company that has achieved unrivaled success and scale in its home state of Florida,” said Steve White, Chief Executive Officer of Harvest. “As one of the oldest multi-state operators, we believe our track record of identifying and developing attractive market opportunities combined with our recent successful launch of adult use sales in Arizona will add tremendous value to the combined organization as it continues to expand and grow in the coming years.”

Terms of the Transaction

Trulieve Announces the Largest US Cannabis Transaction The Transaction will be effected by way of a plan of arrangement pursuant to the Business Corporations Act (British Columbia). Under the terms of the Arrangement Agreement, Trulieve will acquire all of the issued and outstanding Harvest Shares, with each Harvest Shareholder receiving 0.1170 of a Trulieve Share for each Harvest Share, implying a price per Harvest Share of US$4.79, which represents a 34% premium to the May 7, 2021 closing price of the Harvest Shares. After giving effect to the Transaction, Harvest Shareholders will hold approximately 26.7% of the issued and outstanding pro forma Trulieve Shares (on a fully-diluted basis). The Exchange Ratio is subject to adjustment in the event that Harvest completes certain interim period refinancing measures, with the potential adjustment in proportion to the incremental costs from such financing relative to the Transaction value. Additional details of the Transaction will be described in the management information circular and proxy statement (the “Circular“) that will be mailed to Harvest Shareholders in connection with a special meeting of Harvest Shareholders (the “Meeting“) expected to be held in the third quarter to approve the Transaction.

The Transaction has been unanimously approved by the Boards of Directors of each of Trulieve and Harvest. Harvest Shareholders holding more than 50% of the voting power of the issued and outstanding Harvest Shares have entered into voting support agreements with Trulieve to vote in favor of the Transaction.

The Arrangement Agreement provides for certain customary provisions, including covenants in respect of non-solicitation of alternative transactions, a right to match superior proposals, US$100 million reciprocal termination fees under certain circumstances and reciprocal expense reimbursement provisions in certain circumstances.

The Transaction is subject to, among other things, the approval of the necessary approvals of the Supreme Court of British Columbia, the approval of two-thirds of the votes cast by Harvest Shareholders at the Special Meeting, receipt of the required regulatory approvals, including, but not limited, approval pursuant to the Hart–Scott–Rodino Antitrust Improvements Act, and other customary conditions of closing. Approval of Trulieve Shareholders is not required. Additional details of the Transaction will be provided in the Circular.

The Board of Directors of Harvest (the “Harvest Board“) has unanimously determined, after receiving financial and legal advice and following the receipt and review of a unanimous recommendation of a special committee of independent directors (the “Special Committee“), that the Transaction is in the best interests of Harvest, and that, on the basis of the Fairness Opinion (as defined herein), that the consideration to be received by the Harvest Shareholders is fair, from a financial point of view, to the Harvest Shareholders.

The Harvest Board unanimously recommends that Harvest Shareholders vote in favour of the resolution to approve the Transaction. The Special Committee obtained a fairness opinion from Haywood Securities Inc., (the “Fairness Opinion“) which provides that, as at the date of such opinion and based upon and subject to the assumptions, procedures, factors, limitations and qualifications set forth therein, the consideration to be received by the Harvest Shareholders pursuant to the Transaction is fair, from a financial point of view, to the Harvest Shareholders.

Financial and Legal Advisors

Trulieve Announces the Largest US Cannabis Transaction Canaccord Genuity Corp. acted as exclusive financial advisor and DLA Piper (Canada) LLP and Fox Rothschild LLP acted as Canadian and United States legal counsel, respectively, to Trulieve. Canaccord Genuity Corp. also provided a fairness opinion to the Board of Directors of Trulieve.

Moelis & Company LLC acted as financial advisor and Bennett Jones LLP and Troutman Pepper LLP acted as Canadian and United States legal counsel, respectively, to Harvest. Haywood Securities Inc. provided a fairness opinion to the Special Committee.

Conference Call and Investor Presentation

Trulieve and Harvest will hold a conference call and webcast to discuss the acquisition today at 8:30 AM EDT. The conference call may be accessed by dialing 647-427-7450 or 1-888-231-8191 and entering conference ID 8672609. Access to the webcast will be available at Trulieve.com or https://produceredition.webcasts.com/starthere.jsp?ei=1462748&tp_key=b56ece63d6 In addition, an investor presentation providing an overview of the transaction can be accessed on the Investor Relations page of the Trulieve and Harvest investor websites.

About Harvest Health & Recreation Inc.

Headquartered in Tempe, Arizona, Harvest Health & Recreation Inc. is a vertically integrated cannabis company and multi-state operator. Since 2011, Harvest has been committed to expanding its retail and wholesale presence throughout the U.S., acquiring, manufacturing, and selling cannabis products for patients and consumers in addition to providing services to retail dispensaries. Through organic license wins, service agreements, and targeted acquisitions, Harvest has assembled an operational footprint spanning multiple states in the U.S. Harvest’s mission is to improve lives through the goodness of cannabis. We hope you’ll join us on our journey: https://harvesthoc.com.

About Trulieve

Trulieve Announces the Largest US Cannabis Transaction Trulieve is primarily a vertically integrated “seed-to-sale” company in the U.S. and is the first and largest fully licensed medical cannabis company in the State of Florida. Trulieve cultivates and produces all of its products in-house and distributes those products to Trulieve-branded dispensaries throughout the State of Florida, as well as directly to patients via home delivery. Trulieve is also a licensed operator in California, Massachusetts, Connecticut, Pennsylvania, and West Virginia. Trulieve is listed on the Canadian Securities Exchange under the symbol TRUL and trades on the OTCQX Best Market under the symbol TCNNF.

To learn more about Trulieve, visit www.Trulieve.com.

Forward-Looking Statements

This news release includes forward-looking information and statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to each party’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding the Company and Harvest’s expected financial performance for fiscal 2021, the combined operations and prospects of the Company and Harvest, the current and projected market and growth opportunities for the combined company, and the timing and completion of the Transaction, including all the required conditions thereto. Words such as “expects”, “continue”, “will”, “anticipates” and “intends” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the Company and Harvest’s current projections and expectations about future events and financial trends that they believe might affect their financial condition, results of operations, prospects, business strategy and financial needs, and on certain assumptions and analysis made by each party in light of the experience and perception of historical trends, current conditions and expected future developments and other factors each party believes are appropriate. Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein, including, without limitation, the risks discussed under the heading “Risk Factors” in the Company and Harvest’s Annual Reports on Form 10-K for the year ended December 31, 2020 filed with the United Sates Securities and Exchange Commission (the “SEC”) on EDGAR and with certain Canadian regulators on SEDAR at www.sedar.com and in other periodic reports and filings made by the Company and Harvest with the SEC on EDGAR and with such Canadian securities regulators on SEDAR. Although the Company and Harvest believe that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof and, except as required by applicable laws, the Company and Harvest assume no obligation and disclaim any intention to update or revise any forward-looking information and statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking information and statements herein, whether as a result of new information, future events or results, or otherwise.

The Canadian Securities Exchange has not reviewed, approved, or disapproved the content of this news release.

Footnote 1

Trulieve Announces the Largest US Cannabis Transaction This reflects the Adjusted EBITDA of both Trulieve and Harvest on a combined basis for the fiscal year ended December 31, 2020. The most directly comparable GAAP financial measure for Adjusted EBITDA is Net Income (loss), which on a combined basis for Trulieve and Harvest for the fiscal year ended December 31, 2020 was $3.4 million. The following is a reconciliation of Adjusted EBITDA to Net Income (loss) for Trulieve for the fiscal year ended December 31, 2020.

Trulieve Announces the Largest US Cannabis Transaction Footnote 3: CapitalIQ consensus estimates, as May 7, 2021 and prior to release of Harvest’s first quarter 2021 earnings on May 10, 2021. Reconciliation of this non-GAAP financial measure (as defined by the SEC) to the most directly comparable financial measure calculated and presented in accordance with GAAP is not included herein because such non-GAAP financial measure has been obtained from third party sources unrelated to the parties, which do not publish the information necessary for such reconciliation. This non-GAAP financial measure is based on the analysis of non-GAAP financial measures of various financial analysts, each of whom may not be calculating such financial measure in the same manner as each other or Trulieve or Harvest. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP. Our management teams use adjusted EBITDA to evaluate our operating performance and trends and make planning decisions. Our management teams believe adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the items that we exclude. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects of the combined company, and allowing for greater transparency with respect to key financial metrics used by our management teams in its financial and operational decision-making.

SOURCE Trulieve Cannabis Corp.