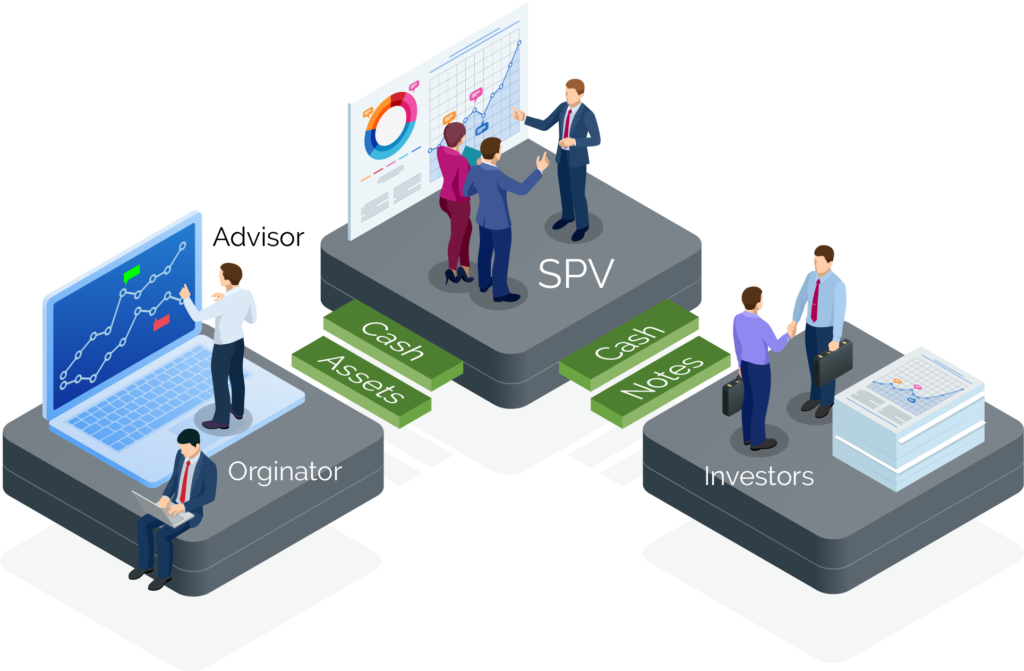

Special Purpose Vehicles (SPVs) are companies incorporated by a parent company with a charter that limits them to the acquisition and financing of specific assets – assets that the parent sells off its own balance sheet. As a subsidiary of a parent company SPVs have their own balance sheet obligations, giving the parent company the ability to work toward its own financial optimization. And, in the context of an SPV designed to sell off a property, that transaction can be done paying lower capital gains tax than paying property sales tax. The Significance of Special Purpose Vehicles in Debt Financing

Special Purpose Vehicle Rationale

The Significance of Special Purpose Vehicles in Debt Financing

Transferring assets off-the-balance sheet to SPVs benefits both companies and investors with The advantages include potentially avoiding bankruptcy, isolating risks, and providing greater return from securitized loans. The advantages and the risks are as follows.

Advantages:

- Risk Mitigation

An SPV, as an independent entity with several shareholders, enables a parent company to legally isolate risks associated with properties or projects. With the parent company owning just a small percentage of the SPV, risks of a project are then shared with other shareholders. In addition, funds borrowed by the SPV have limited impact on the parent. Assets and liabilities acquired by a loan to the SPV become part of that company’s balance sheet, giving creditors claim to only the SPV’s assets if the parent fails to meet its debt obligations.

- Securitization of Assets

Assets from the parent company are sold to the SPV which pays for them with securities issued to investors in the capital markets. The principal and interest of the securities are paid from the revenue flow of the purchased assets. Assets of the parent company become “remote” in the event of bankruptcy of an SPV since the assets not sold to the SPV are not at risk. (Insolvency by the SPV is unusual however; since, typically, the SPV has no other indebtedness than payment obligations on the asset loans or securities.)

- Securitization of Loans

Securitization of loans is one of the most appealing factors for SPV alternative debt financing. Within the SPV investors receive all monetary benefits before any other debtors or stakeholders in the company.

- Reduced Cost of Accessing Credit

A well-capitalized SPV by the parent company is likely to assure a good credit rating for the new entity which brings with it the reduced cost of borrowing, along with exemption from certain direct taxes.

- Transfer of Non-Transferable Assets

As often occurs in the case of Mergers & Acquisitions, when a company wants to divest assets, it can do so by selling off its SPV, rather than having to get special permits or clearances when selling for certain types of assets.

- Facilitation of High Leverage Financing

With assets now in the SPV the parent company has the potential of debt financing up to 90% of a property or project.

- Potential for High Rate of Return for Investor

Investors are paid based on the value provided by the assets in the SPV. This potential is enhanced when the Internal Rate of Return (IRR) of this collateralized asset exceeds the cost of capital.

- A Hold on a Company’s Key Assets

Relating back to tax advantages, a company my hold its property assets in an SPV and sell the SPV when the value of the property exceeds the company’s capital gains, thus using the sales revenue from the SPV to pay the company capital gains tax – at it lower rate than real estate taxes on individual property sales.

- Example of REITS Turning to SPVs

The benefit of investing in a REIT is the rental income from its properties. A REIT using an SPV can yield interest income from mortgage-based securities of money loaned to the real estate owners, while the SPV provides dividend income as well.

Risks:

In general, the primary concerns about SPVs center around complexity of monitoring the level of risk and potential damage to parent company’s access to capital if their SPV underperforms. As in all forms of alternative finance risk assessment and management are crucial; the absence of which has led to three highly publicized big business failures in the past.

During the financial crisis of 2008 two prominent, respected brokerage firms, Bear Sterns and Lehman Brothers, collapsed under the burden of the deflated value of the securitized assets held by multiple SPVs that they had created. For Bear Sterns it was a problem of over exposure at the time of the real estate value collapse. For Lehman Brothers it was a case of attempting to maintain SPVs using Swap Counterparty agreements – interest rate swap agreements. Without proper risk management of the various SPVs, Lehman was also pulled into bankruptcy.

The most publicized of these bankruptcies was the folding of Enron, the now notorious energy company. Their intent was proven to be in 2001 that they were using multitude SPVs to raise cash from the sales of shares in the SPVs, a tactic that was mostly a ploy to hide billions of dollars of debt in the SPVs, leading to Enron’s bankruptcy in 2011.

Regulatory Reforms

Since those high-profile business failures new rules have been implemented under the Third Basel Accord, Basel III, and earlier Basel II, that impose the following on SPV formation and transactions:

(Provide this link for clicking onto Basel III in the sentence above:

- Requirements for more strict risk management scrutiny by companies and regulators

- Emphasis placed on default risk as companies define their capital market strategies

- Demand for more thorough/consistent use of valuation ratios when restructuring a company’s capital

- More detailed requirements for the types/completeness of lending documents

- Enforcement of strict compliance with state-by-state security regulations under “Blue Sky Laws”

Investor Guidance

Risk assessment and effective due diligence are the steps through which we guide our clients in counselling prior to investment in an SPV. The steps in that process are as follows:

- Examine the basic business case of the SPV. Has the parent company substantiated the goals of the investment and likelihood of generating the necessary cash flow?

- Determine if the most prominent risks have been identified and strategies developed to mitigate them. As in all investing the old adage applies here, “unidentified risk cannot be mitigated.”

- Have the most favorable price and repayment schedule for the loan been negotiated?

- What monitoring safeguards are in place to evaluate the financial reports on the investment progressing toward the repayment objectives.

What An Example of an SPV Offering Looks Like

To more fully explain the process here is an example of the elements of an offering by a biopharma client seeking growth funding through an SPV.

Commercial Real Estate Example

- Project: operating company with projected year one revenue of $20M and EBITDA of $2M is the “tenant.”

- The operating company and the real estate company are owned by the same investors.

- The operating company has a portfolio of commercial properties they have already purchased.

- The company is seeking debt to fund operational and build out needs for each property by refinancing the properties. The $15M in properties will use $7M for TI and build out for an improved property total cost of $20M

- Highway 33 Capital will manage and service the loan in the US

- Highway 33 Capital will only take up front closing fees and any return above 10% annually for its time and expense to close and service the loan

- The investor will be preferred and receive a 10% annual return

- Terms of the loan:

- 4 Year Term

- 12% annual interest rate

- 3% fee at close

- Personal guarantees for investors owning more than 15% of equity, cross corporate guarantee from the operating company, 1st lien on all the subject properties

- No more than 75% Loan-To-Value advance rate based on improved appraised value or project cost whichever is lower

- No pre-payment penalties

- Highway 33 Capital has a full online diligence locker of information on the properties and the operating company that can be shared once we have a non-disclosure agreement

- Investor review of the terms and the project data locker materials is required

- Discuss interest and any additional data/documents necessary to make a financial commitment to fund the loan

- Have legal counsel generate SPV documents for the debt investment

- Highway 33 Capital will issue a term sheet to the borrower and if accepted then proceed through diligence for environmental studies, local permitting, budget confirmation, assuring borrower ownership, and producing legal loan documents to close

- Highway 33 Capital will pay the investor their preferred 10% return annually through the term of the loan

Investor Takeaway

Special Purpose Vehicles are designed to enable the operating company to access off-balance-sheet financing through the transfer of assets and liabilities to an independent entity. The operating company, then, has access to low cost capital while protecting its core business from risks that may be associated with a specific project and with the credit exposure of the project. SPVs are potentially high return debt financing investments as long as there is a fully substantiated business case presented by the borrower. Based on previous misuse of this form of alternative financing regulatory safeguards are in place to aid in minimizing the risks involved when using this tool to separate financial responsibilities. These benefits, however, are only likely to be realized after due diligence of the various potential investment risks. The Significance of Special Purpose Vehicles in Debt Financing

How We Can Help

At Highway 33 Capital Advisory we are standing by with the expertise and experience to provide guidance with debt financing alternatives. We excel at structuring deals to meet client investment strategies in trending segments like biopharma as well as our core expertise with highly regulated markets in the fields of biotech, healthcare, agtech, cannabis and CBD/hemp companies as well as technology companies. We specialize in thoroughly vetted companies that are looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+. The Significance of Special Purpose Vehicles in Debt Financing

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.