Investor Takeaway SPACs in Cannabis – Mixed Bag of Results

The capital and legal restraints the cannabis industry has experienced have given rise to alternative funding sources to finance the industry’s unprecedented growth potential. Prominent among these are SPACs. Special Purpose Acquisition Companies are, indeed, bringing substantial liquidity to this capital constrained industry – providing cannabis companies with the competitive advantage of a substantially shorter period of time to De-SPAC to access public markets more quickly than the traditional IPO process. Yet, IPO’s have experienced hot and cold market swings. Is it inevitable, as some predict, that SPACs/Cannabis SPACs will experience the same cycles? In the final analysis, the most important factors in decisions about a SPAC investment are the caliber and trust embodied in the senior management of the SPAC, and the seasoned advisors who can assist with the most critical due diligence required to make a sound investment.

SPACs in Cannabis 2022 SPACs in Cannabis – Mixed Bag of Results

The capital and legal restraints the cannabis industry has experienced have given rise to alternative funding sources for this massive investment opportunity. While many VCs and virtually all major institutional investors are still on the sidelines until federal legalization takes place, alternatives to accessing capital have arisen in the form of M&A transactions utilizing Special Purpose Acquisition Companies (SPACs). SPACs are, indeed, bringing substantial liquidity to maintain sales growth and provide cannabis companies with the competitive advantage of more quickly getting to market.

SPACs, according to Benzinga, have been a significant part of the cannabis landscape since the 2017 IPO of Cannabis Strategies Acquisition Corp, (now AYR Wellness). Into December of last year, twenty-three cannabis SPAC IPOs had been completed for total proceeds of $4.24B. Eight of these representing initial IPO proceeds of $1.72B, merged with cannabis-related companies, and 10 representing original IPO proceeds of $1.60B were still either looking for deals ($1.2B) or have transactions pending ($.4B).

The Major Players SPACs in Cannabis – Mixed Bag of Results

The New Cannabis Ventures SPAC tracker lists these as the active SPACs in Cannabis at this time:

Current Transactions

This intensity in SPACs in cannabis built up substantial momentum in 2021. Into this year, major transactions include:

Canna-Global Acquisition Corp (CNGLU)

This California-based SPAC began trading having raised $200 million in December through an initial public offering on Nasdaq targeting companies involved in growing medical cannabis or production of cannabinoids. The company’s objective is to become a “best-in-class” multistate cannabis operator (MSO) from cultivation to production and processing, to sales and distribution. Initially, though, investment prospects appear to be ancillary cannabis businesses that are not in violation of the U.S. Controlled Substances Act.

Leafly (Nasdaq LFLY)

GeekWire reported earlier this month that six months after announcing plans to go public via a SPAC merger, Seattle-based online cannabis marketplace Leafly began trading on the Nasdaq last week after a SPAC merger with Merida Merger Corp. Leafly, an industry online marketplace for legal retailers and a cannabis education platform, has more than 125 million annual visitors. Subscribing businesses generated $36 million in revenue in 2020, with it expected to reach $151 million by 2024.

Safe Harbor

Last week Market Watch reported that this pioneer in commercial cannabis lending platforms is being acquired by Northern Lights Acquisition Corp. for $185 million, including $70 million in cash and $115 million in Northern Lights stock. The transaction also includes a $60 million private investment in public equity (PIPE) deal with unnamed institutional investors.

In 2021, Safe Harbor handled 600 accounts in 20 states, and processed more than $11 billion in transactions, including $4 billion in 2021. Safe Harbor’s compounded annual growth rate was for its deposits is 73% since its inception. The SPAC acquisition of Safe Harbor comes as two business development companies that provide debt financing to cannabis companies have debuted their initial public offerings.

The post-merger valuation of the combined company will be $327 million.

Propelling the Emergence of SPACs in Cannabis SPACs in Cannabis – Mixed Bag of Results

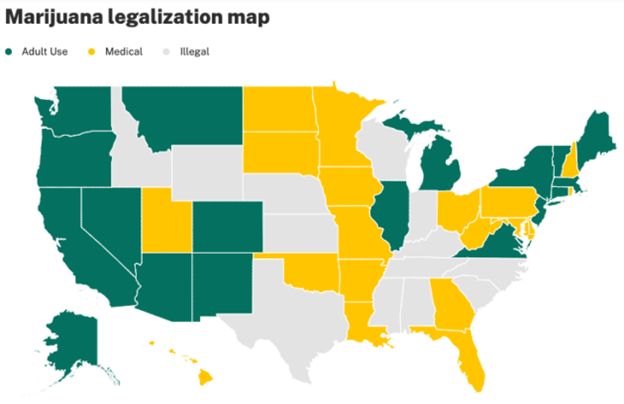

With the relentless Green wave sweeping across the country on a state-by-state basis, the industry has matured to the point where major players are now focused on strategic acquisitions, efficient operations, and generating EBITDA. With what has traditionally been timid PE investors and little to no participation by FDIC-insured bank lenders, cannabis companies were running out of options to raise capital for growth opportunities. SPACs create a route toward access to the public markets that has previously been unavailable.

Institutional investors, particularly in the case of federally insured banks and pension-backed VC or private-equity firms are prohibited from businesses dealing directly in Schedule I Controlled Substances. That leaves a very narrow pool of investors, opening a huge gap that SPACs can readily fill. The capital and legal restraints the cannabis industry has experienced have shown the flaws in traditional approaches for a new industry to raise funds. Particularly in the case of the banker-centric IPO process.

And, just as importantly, the industry is transitioning from its volatile beginnings just a few years ago to becoming the world’s largest consumer products industry.

But, Are SPACs Performing? SPACs in Cannabis – Mixed Bag of Results

GeekWire points out that into 2022, some stocks are tumbling and some deals are being abandoned in the general SPAC marketplace. In cannabis, Benzinga reports the findings of Viridian Research that only two companies yielding post De-SPAC returns outperformed the cannabis ETF market.

While SPACs are thriving in the hot marketplace cannabis investing has become, their end result, is accessing public markets. Traditional IPO’s repeatedly experience hot and cold market swings. It has appeared so far into 2022 that, as many predicted, SPACs/Cannabis SPACs will experience the same cycles.

- SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up.

- How many “Redemptions” the SPAC has to account for should be scrutinized. This refers to the amount of money investors may have withdrawn when they object to the proposed merger. The less money to be “redeemed,” of course, the greater the likelihood of a better return for investors who stuck with the M&A transaction of SPAC management.

- And there are improvements in the basic structure of a SPAC that bear scrutiny. Changes include reducing the subsidy accruing to the benefit of the sponsor to be more in line with SPAC shareholder interests. This is needed to level the playing field on forecasts and business “stories” that the SEC is currently questioning. The objective of the SEC is to more tightly follow the IPO disclosure process and reduce the deal underwriting costs. These costs often run as high as 5 to 6 %.

While SPACs are already evolving to become a SPARC (special purpose acquisition rights company) to address some of the shortcomings of the SPAC process.

Choosing the Cannabis Target for Acquisition

Typically, the hurdles facing a cannabis SPAC are the same faced by traditional M&A transactions. In cannabis the SPAC will need to comply with state and municipality licensure requirements before closing. And additional rules will need to be followed when applying for a listing on a stock exchange. With the reluctance of U.S. exchanges to list U.S. holders of cannabis licenses, major transactions to this point in time have transpired on the Canadian exchanges.

What will the SPAC look for as an ideal cannabis target? Here are key factors that are, in fact, similar to any cannabis M&A transaction

- Knowledgeable Shareholder Base.

Critical for a knowledgeable shareholder base to understand the business/technology being acquired.

- Management with Proven Operational Experience.

Preferably operational experience negotiating through the compliance, regulatory and financial issues specific to the cannabis industry.

- M&A Strategy Fulfilling the Vision for Future Growth.

- Precise Financials and Attainable Pro formas.

This is vital valuation of assets the merger provides.

- Planned Integration of Company Cultures.

Maintaining employee retention when a deal occurs is always critical. And ongoing policies that promote ESG (Economic, Social and Governance) issues are becoming a standard requirement in current M&A transactions.

Investor Takeaway

The capital and legal restraints the cannabis industry has experienced have given rise to alternative funding sources to finance the industry’s unprecedented growth potential. Prominent among these are SPACs. Special Purpose Acquisition Companies are, indeed, bringing substantial liquidity to this capital constrained industry – providing cannabis companies with the competitive advantage of a substantially shorter period of time to De-SPAC to access public markets more quickly than the traditional IPO process. Yet, IPO’s have experienced hot and cold market swings. Is it inevitable, as some predict, that SPACs/Cannabis SPACs will experience the same cycles? In the final analysis, the most important factors in decisions about a SPAC investment are the caliber and trust embodied in the senior management of the SPAC, and the seasoned advisors who can assist with the most critical due diligence required to make a sound investment.

How We Can Help

At Highway 33 Capital Advisory we excel at mitigating investor risk through extensive due diligence and structuring SPAC transactions to meet client investment strategies in emerging 2022 opportunities – with our core expertise in Cannabis along with highly regulated markets in the fields of Pharma, Biotech, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.