SPACs in Cannabis 2021 In last week’s EGDE we reported that through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during that same period in 2020. The industry is, in fact, booming. 2021 is becoming the most lucrative year in the history of legal cannabis in the U.S. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion this year, $84 billion by 2028. And, just as importantly the industry is transitioning from its volatile beginnings just a few years ago to becoming more like a traditional CPG marketplace. While many VCs and virtually all major institutional investors are still on the sidelines until federal legalization takes place, alternatives to accessing capital have arisen in the form of M&A transactions putting the use of Special Purpose Acquisition Companies (SPACs) in the limelight for cannabis companies in the U.S. and in Canada to access capital over traditional sources and in order to pursue the path of going public.

SPACs in Cannabis 2021

As you recall from our previous articles on this subject, although being around for decades as an alternative finance tool, SPACs, also called “blank check companies,” are formed to raise money through an IPO specifically to buy another company. At the time of an IPO filing a SPAC needs neither existing business operations, nor even a stated target for acquisition. By the end of two years the SPAC must complete an acquisition (a “de-SPAC’) or return all funds to all investors. SPAC investors, therefore, have no idea into which company their money will be invested, requiring confidence in an experienced management team and/or sponsor.

SPACs engage underwriters and institutional investors before offering shares to the public. Funds cannot be disbursed except to complete a specific acquisition. And, after the de-SPAC the acquisition is commonly listed on a major stock exchange. Founding management team and sponsors typically invest in a 20% interest in the SPAC with the remaining 80% interest held by public shareholders of “units” of the IPO – a common share of stock along with a fraction of a warrant. All shares have similar voting rights. SPACs in Cannabis 2021

Recently in Seeking Alpha, Professor Aswath Damodaran of the Stern School of Business, New York University in an article entitled: The Rise Of SPACs: IPO Disruptors Or Blank Check Distortions? summarizes the current situation with SPACs in this manner:

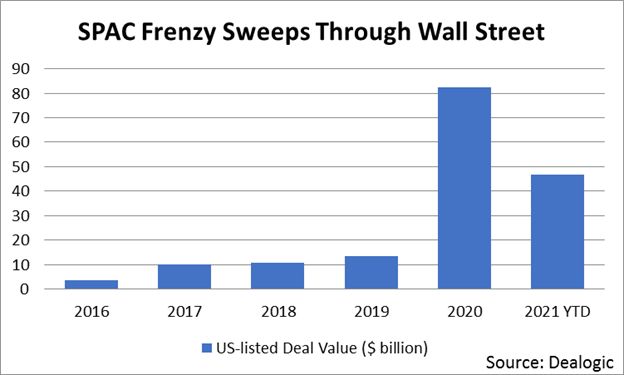

- In 2020, SPACs accounted for more than half of all deals made, in terms of dollar value, and SPACs are running well ahead of that pace in 2021.

- In sum, SPACs are as much a reflection of the times that we live in, as they are a potential solution to the going-public problem.

- In an ironic twist, the SPAC process, designed to disrupt the traditional IPO, may be seeing the beginnings of a disruption of its own.

After a thorough comparison of the IPO versus the SPAC process and results, Professor Damadoran states:

Put simply, the traditional IPO process takes too long, costs too much and leaves both issuing companies and investors dissatisfied, the former because the process takes too long and is too inefficient, and the latter because they feel that only a select few can partake at the offer price.

SPACs in the Capital-Constrained Cannabis Industry

2021 is predicted to be a banner year for the cannabis industry as the pace of the baby-steps toward legalization start gaining stride. While national legalization is still on the more distant horizon, it is likely that passage of the SAFE Banking Act will be an aggressive step forward on a national basis. Coming out of COVID-19 all states are facing unfathomable revenue shortfalls and will be scrambling for more sources of tax revenue. This places renewed pressure on local jurisdictions to look to the revenue-generation/employment-creation potential of cannabis cultivation/ production/sales.

The industry has matured to the point where major players are now focused on strategic acquisitions, efficient operations, and generating EBITDA. With what has traditionally been timid PE investors and little to no participation by FDIC-insured bank lenders, cannabis companies were running out of options to raise capital for growth opportunities. SPACs create a route toward access to capital that has previously been unavailable. SPACs in Cannabis 2021

Interestingly, SPACs are expected to play a major role in Canada as well as the U.S. where a shake out is forecast among public companies that will be forced to either merge for survival or face the prospect of bankruptcy.

SPACs allow companies to gain quicker access to liquidity. An IPO, the traditional approach to go public, can take up to a year to fully execute. A SPAC, however, can shorten that process, negotiating and closing included, to just a few months. So, in reality, SPACs do afford unmatched benefits over IPO’s to both sponsors and targets.

- Owners of smaller-size companies can gain greater access to funding, often enjoying a significantly higher selling price than private equity transactions, and receive what amounts to an expedited IPO process by an experienced acquisition management team.

- Sponsors can not only receive a high rate of return relatively quickly from a de-SPAC, but can also be guaranteed a large war chest to invest in targets, required in a short period of time.

- In addition, a study by the Warrington College of Business at the University of Florida found that it can be shown that IPOs, in general, very often underdeliver. It was found that in the last decade IPOs were underpriced by as much as 21%. From their calculations an average of $37M went unrealized.

History of SPACs in Cannabis

While federal illegality has prohibited plant-touching cannabis companies from trading on the NYSE or the Nasdaq, the first cannabis SPAC deal was announced in October, 2018 (closed in June, 2019) when MTech Acquisitions, the first US-listed SPAC chartered to concentrate on the acquisition of non-plant touching businesses ancillary to the cannabis industry, announced its purchase of MJ Freeway, the developer of the industry’s first enterprise resource planning platform. Following closely on the heels of that announcement, in November, 2018 (closed April, 2019) Canaccord Genuity Growth Corp, a Canadian SPAC incorporated to transact on the NEO Exchange, performed a “de-SPAC” acquisition of Columbia Care LLC to form Columbia Care Inc., now with a dual-listing on the NEO Exchange and the CSE. Since then, SPAC M&A transactions in Cannabis have increased dramatically with major industry deals consummated by Subversive Capital Acquisitions Corp., Silver Spike Acquisitions Corp., Greenrose Acquisitions Corp., Schultze Special Purpose Acquisitions, Ayr Strategies, among others.

Choosing the Cannabis Target for Acquisition

Typically, the hurdles facing a cannabis SPAC are the same faced by traditional M&A transactions. In cannabis the SPAC will need to comply with state and municipality licensure requirements before closing. And additional rules will need to be followed when applying for a listing on a stock exchange. With the reluctance of U.S. exchanges to list U.S. holders of cannabis licenses, major transactions to this point in time have transpired on the Canadian exchanges. SPACs in Cannabis 2021

What will the SPAC look for as an ideal cannabis target? Here are key factors that are, if fact, similar to any cannabis M&A transaction:

- Knowledgeable Shareholder Base.

Critical for a knowledgeable shareholder base to understand the business/technology being acquired.

- Management with Proven Operational Experience.

Preferably operational experience negotiating through the compliance, regulatory and financial issues specific to the cannabis industry.

- M&A Strategy Fulfilling the Vision for Future Growth.

- Precise financials and attainable pro formas.

This is vital valuation of assets the merger provides.

- Planned Integration of Company Cultures.

Maintaining employee retention when a deal occurs is always critical. And ongoing policies that promote ESG (Economic, Social and Governance) issue are becoming a standard requirement in current M&A transactions.

SPAC Investor Considerations

The capital and legal restraints the cannabis industry has experienced have shown the flaws in traditional approaches for a new industry to raise funds. Particularly in the case of the banker-centric IPO process. SPACs appear to be the answer for a better route for cannabis companies to follow to access public markets. And, SPACs are thriving in the hot marketplace cannabis investing has become. Yet, IPO’s have experienced hot and cold market swings. Is it inevitable, as some predict, that SPACs/Cannabis SPACs will experience the same cycles? SPAC mergers often depend on funds coming from Private Investments in Public Equity (PIPE) deals. PIPE investors often step in to replace capital from IPO investors who opt out of a SPAC merger. Some have voiced the concern that there may not be enough resources to go around for all the potential SPAC deals as funding from PIPE investors dries up. And, there are improvements in the basic structure of a SPAC that bear scrutiny. The article by Professor Damadoran we cited earlier in this article while favorable for the future of SPACs specified the procedures for change that would make them more effective for short-term and medium-term gains for all shareholders instead of the disproportionate benefit (the 20% subsidy) that a sponsor now enjoys. These recommended changes include reducing the sponsor subsidy to be more inline with SPAC shareholder interests, leveling the playing field on forecasts and business “stories,” as the SEC is currently questioning, in order to more tightly follow the IPO disclosure process, and reducing the deal underwriting costs, which often run as high as 5 to 6 %. While, just as you will see in the third article in today’s EDGE. SPACs are already evolving to become a SPARC (special purpose acquisition rights company) to address some of the shortcomings of the SPAC process.

Investor Takeaway

In last week’s EGDE we reported that through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during that same period in 2020. The capital and legal restraints the cannabis industry has experienced have given rise to alternative funding sources for this massive investment.

Prominent among them is the SPAC. SPACs are, indeed, bringing substantial liquidity to maintain sales growth and provide cannabis companies with the competitive advantage of more quickly getting to market. In many cases the SPAC merger process with a target company, termed to “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline – proving to be a better route to access public markets Yet, IPO’s have experienced hot and cold market swings. Is it inevitable, as some predict, that SPACs/Cannabis SPACs will experience the same cycles? In the final analysis, the most important factor in decisions about a SPAC investment is the caliber and trust embodied in the senior management of the SPAC, and the seasoned advisors who can assist with the most critical due diligence required to make a sound investment.

How We Can Help

Once the vetting process is completed our contact list numbers in the thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our Non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials.

At Highway 33 Capital Advisory we excel at mitigating investor risk through extensive due diligence and structuring SPAC transactions to meet client investment strategies in emerging 2021 opportunities – with our core expertise in Cannabis along with highly regulated markets in the fields of Pharma, Biotech, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.