March 29, 2022

Posted by New Frontier Data

Cannabis Insights, Cannabit

By John Kagia, Chief Knowledge Officer, New Frontier Data Coexisting Cannabis Markets: The Interplay of Medical Versus Adult Sales

In the new 2022 U.S. Cannabis Report: Industry Projections & Trends, New Frontier Data analyzes growth and trends shaping the U.S. medical cannabis industry. With 38 state markets (plus Washington, D.C.) operating legal medical cannabis markets, the total number of registered medical cannabis patients nationwide surpassed 4.4 million in 2021. In those states where cannabis has been legalized for medical use (with no assumptions of any new medical markets by 2030), New Frontier Data projects that there will be a combined 5.7 million registered medical cannabis patients by 2030, representing nearly 2% of the nation’s entire population.

Patient Satisfaction

The central reason for states’ approving the inclusion of cannabis to their medical programs is broadly affirmative feedback from patients that it works. According to New Frontier Data’s latest cannabis consumer research, 93% of patients using cannabis medicinally report that their conditions have improved, with 57% reporting that they have improved significantly.

Chronic pain continues to be the leading reason patients participate in the medical market, with nearly half (47%) of consumers surveyed citing pain as a reason for medical use. However, those medical consumers also cited a wide range of other physical and mental conditions for their cannabis use, including anxiety/panic attacks (22%), depression and sleep disorders (9% respectively), PTSD (7%) or gastrointestinal disorders (3%).

While significant questions remain about precisely why cannabis seems effective for such a wide range of conditions, the fact that patients suffering so broadly also so consistently report improvement is increasing overall confidence within the healthcare community to recommend cannabis and further expand the base of patients willing to try medical cannabis.

Expanding Qualifying Conditions

The regulatory structure of each state market holds major implications for both how fast and how large that medical market will grow, with the list of qualifying conditions being the primary determinant of how quickly patients will join a program. While most states prescribe a specific list of qualifying conditions, some (including California, Oklahoma, and Washington D.C.) permit physicians and other qualified health-care practitioners to recommend cannabis for any condition which a provider believes might be improved through the use of cannabis.

Markets have also been seeing a general easing of medical cannabis regulations. Though states often begin with tight regulations governing their medical markets, those regulations over time are often eased, subsequently encouraging more patients to join a given program. For more comprehensive and specific data and analysis, visit New Frontier Data’s online business intelligence portal Equio® to gain additional insights available within the U.S. Market Dashboard.

That phenomenon typically happens in two ways, with the first being to add new qualifying conditions. Illinois, for example, in 2019 added 11 new conditions (including chronic pain) six years after the state first approved medical cannabis. The second method is by granting physicians’ discretion, allowing the assessment of qualifications to any patient’s health-care provider. New York is the most recent example: In January, the state not only granted physicians discretion to recommend cannabis as they see fit, but also added dentists, podiatrists, and midwives to the rolls of health-care providers authorized to recommend medical cannabis.

Patient Saturation Sets the Pace

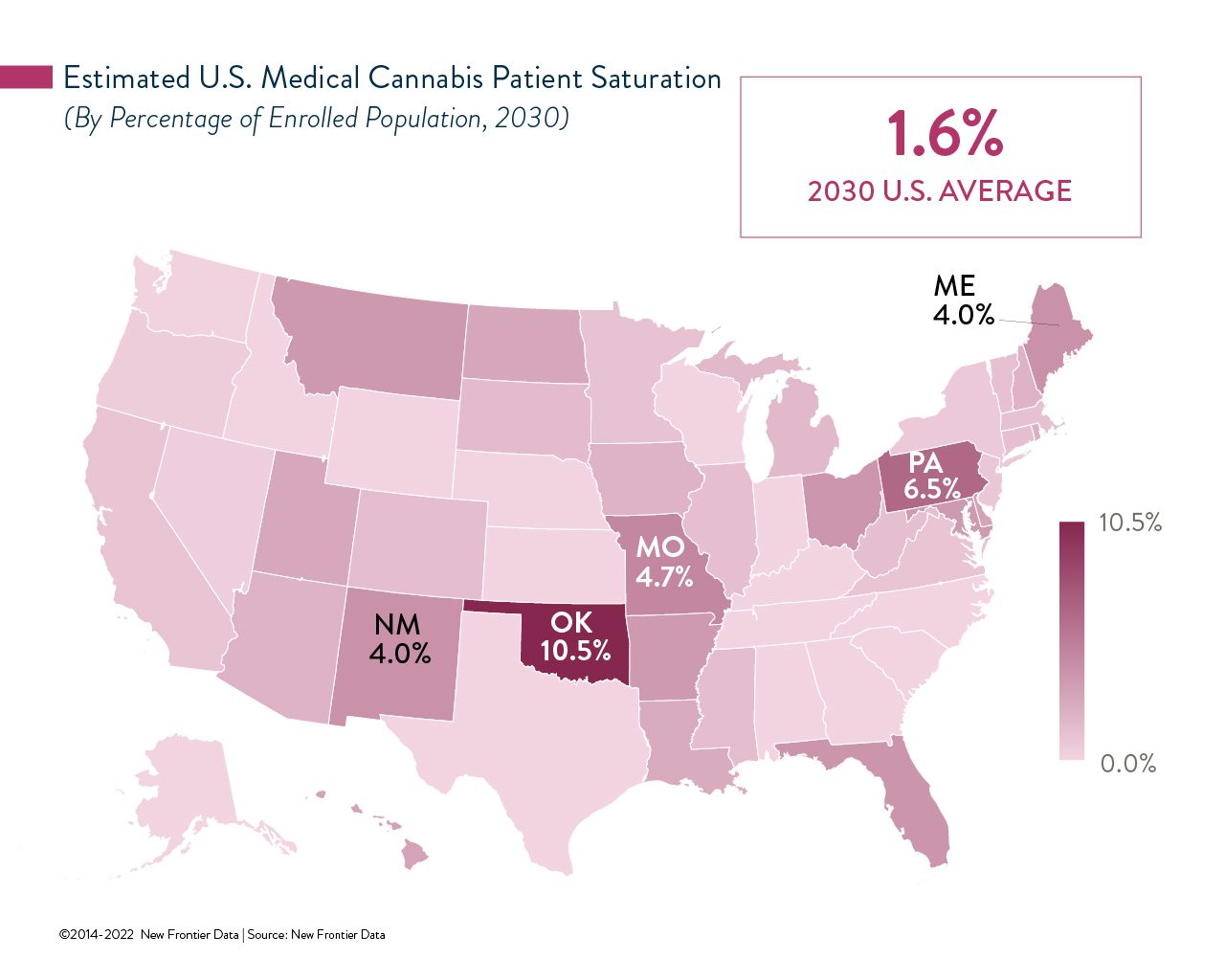

Given such regulatory variability, the percentage of adults participating in state medical programs will vary widely in coming years. By 2030, New Frontier Data forecasts Oklahoma, barring major regulatory changes, to have the country’s highest patient saturation, including more than 10% of state’s residents registered in the program. Other leading medical markets are expected to include Pennsylvania, Missouri, Maine, and New Mexico – each of which is expected to see a patient saturation rate of at least 4%.

Regulatory interplay between a state’s medical and adult-use markets also plays a significant role. Colorado and Washington – two of the first states to legalize adult-use markets – illustrate well how different regulatory approaches can impact one’s medical market.

Eight years since adult-use sales began in Colorado, the state’s number of registered patients has fallen 22%, from a little over 111,000 to just over 86,000. That represents strongly sustained participation in the state’s medical market, where medical cannabis is not subject to Colorado’s 15% cannabis excise tax, and the retail prices for cannabis products are, on average, significantly lower than in its adult-use market. Furthermore, with a physician’s approval, medical patients may purchase beyond the state’s adult-use purchase limits, enabling price-conscious and high-consuming patients to enjoy significant savings.

Conversely, Washington State sought to harmonize its medical and adult-use markets by eliminating its medical market accommodations. By cutting benefits from the medical program (particularly a break from the state’s 37% excise tax rate, one of the highest in the U.S.), Washington eliminated the utility in participating in the state’s medical program, instead driving patients into the adult-use market or, worse, the more affordable illicit space.

With medical consumer feedback and clinical research both strengthening the case for medical cannabis, medical markets are expected to continue enjoying both robust growth and fewer limitations on who is allowed to participate in those programs. Furthermore, as the U.S. lumbers toward national reform serving to stimulate domestic investment in clinical research, New Frontier Data expects progressively sophisticated research to refine our collective understanding of why cannabis works, and for which among increasing catalogs of conditions and treatments it will be proven most effective and popular.