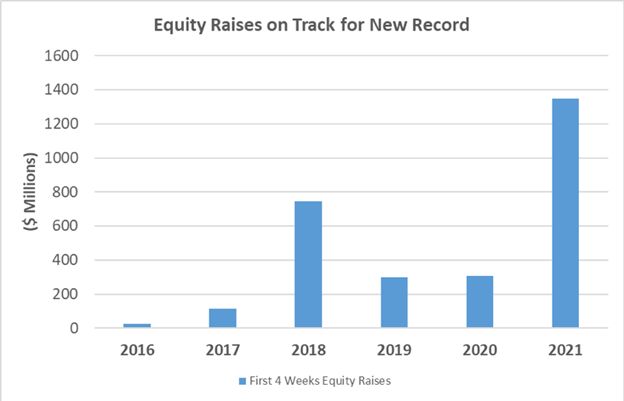

As we reported in the EDGE Briefing last week, 2021 is becoming the most lucrative year in the history of legal cannabis in the U.S. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion this year, $84 billion by 2028. And, capital flowing into the industry this year is at a record pace. Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during the same period in 2020. The transition of this new market is beginning from its volatile beginnings just a few years ago to becoming more like a traditional CPG marketplace. And this is even before Big Tobacco and Big Pharma get more deeply into the industry to bring their level of professional management to cannabis operations.

Here is a look at some of the action going on in the capital flow into the industry.

Recent Equity Transactions

The majority of the capital flowing into the cannabis industry via the private equity and IPOs has been through large multistate operators (MSOs):

- TerraAscend Corp (CSE:TER)(OTCQB:TRSSF), one of the largest MSOs closed a non-brokered private placement raising C$224 million. The vast majority of this capital coming from what is reported to be four large U.S. institutional investors.

- Last month Oklahoma-based Stability Cannabis, which operates a 95,000 sq. ft. indoor cultivation with additional acreage for greenhouse and outdoor grow raised $44 million in a Series A Round of venture capital financing.

- New York-based, vertically integrated MSO Ascend Wellness Holdings Raised $80 million in an IPO in May. You may recall that Ascend acquired the majority of MedMen’s New York businesses earlier this year.

- In an attempt to begin resolving their long-term liquidity issue Aurora Cannabis (NAS:ACB) last week closed a US$137.9 million public offering with 13.2 million units at US$10.45 per share. This transaction values Aurora at 5.6x its projected 2021 revenue and 61.8x projected 2021 EBITDA.

Capital Creation from M&A Transactions

In March, U.S. News reported that the U.S. cannabis industry had already raised $2 billion in equity capital in 2021. That total was dwarfed on May 10 when in one transaction alone Trulieve acquired Harvest for over $2 billion. Here is a look at the major transaction activity to date:

- In that transaction Trulieve (CSE: TRUL ) (OTC: TCNNF) acquired Harvest Health and Recreation (CSE:HARV, OTCQX: HRVSF) in a $2.1 billion deal that forms in the U.S. what is reported to be the “world’s most profitable multi-state operator.” This is based on the combined adjusted EBITDA of $461 million that Trulieve projects for 2021. Trulieve will now have a retail network of 126 dispensaries across 11 states which they state gives them “an unparalleled platform for continued growth.”

- In January, Canopy Growth announced the filing of an early warning report on maintaining an option for a 20% pro rata ownership interest in TerrAscend. As you have probably watched this mega-deal with us, the final transaction between these two giants is contingent on changes to the Federal regulations on the classification of cannabis in the U.S.

- Following this development TerrAscend closed the acquisition of U.S. companies GuadCo, LLC and KCR Holdings LLC for roughly US$70 million which will expand dispensary operations in Southeastern Pennsylvania.

- Then, In early April came the long-anticipated announcement that Canopy Growth Corp finalized the agreement to acquire Supreme Cannabis Company in a mega-deal valued at US$346 million. Closing is expected this month. Canopy, as you may recall, currently has the largest market cap of all the Canadian cannabis pubcos on the strength of a US$4 billion investment by Constellation Brands.

- With more interest in cannabis being evinced by Big Tobacco, British American Tobacco provided a cash infusion that enabled Organigram Holdings (NASDAQ:OGI,TSX:OGI) to announce the coming acquisition of The Edibles & Infusions Corp. with cash and shares transaction.

- In February, one of the most significant mega-deals in the cannabis industry closed when Ireland-based Jazz Pharmaceuticals invested $7.2-billion for United Kingdom-based GW Pharmaceuticals. GW Pharmaceuticals is the pioneering pharma manufacturer what was successful in obtaining U.S. FDA approval of the cannabis-based epilepsy drug Epidiolex.

- Cresco Labs (CRLBF), a Chicago-based MSO which now operates in 9 states acquired Bluma Wellness for $213 million.

- Among numerous deals, Verano – the Chicago-based MSO that has been on an acquisition roll of dispensaries in Arizona, Pennsylvania and Ohio – closed its acquisition of Florida-based Alternative Medical Enterprises (AltMed) in February for an undisclosed amount.

- For a 31.5% position in Curaleaf International, Curaleaf Holdings (CSE:CURA,OTCQX:CURLF) secured a US$130 million investment from a source described as a “strategic institutional investor.” This is an extension of the company’s Green Wave of Acceptance strategy that began last year with the US$200 million offering made on the CSE that turned out to be over-subscribed to the tune of US$251 million.

- Green Thumb Industries Inc. (CSE:GTII ) (OTCQX: GTBIF), recently announced the inking of an agreement to acquire 100% of Dharma Pharmaceuticals, the medical cannabis distributor in Virginia.

- And, in May the final process was set in motion for Canadian cannabis giants the Aphria -Tilray reverse acquisition. According to the companies, this merger will create the world’s largest cannabis company based on revenue. That is based on the estimated 2020 revenue of the combined Tilray-Aphria of $874 million, putting it ahead of U.S. MSO Curaleaf Holdings at $842 million and Canada’s Trulieve at $602 million.

Cannabis Industry Maturing to the Point of Turning to Debt

As more debt providers come online, recent multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic – to use debt financing for competitive advantage in the marketplace.

While the industry has been capital-constrained, borrowing against assets has been a key source available for many cannabis companies to pursue. Vertically integrated cannabis companies often have significant real estate and other assets that can be leveraged. What has changed now, though, is that more debt providers have come online over the past couple of years addressing a range of needs. This means that cannabis companies can now refinance at more attractive rates. Significant developments:

- In 2020, large MSOs Curaleaf and Cresco Labs announced their debt raises of approximately $300M and $200M, respectively, illustrating the capital available at the high-end of the market at that time. Then, on January 11 this year, Curaleaf has again secured a new round of financing – a $50 million secured revolving credit facility with a three-year term. Curaleaf will be paying a 10.25% interest rate for funds when needed. This is significantly lower than the interest rates cannabis companies paid for loans in previous years when the likelihood of progress on easing Federal regulations did not look as promising.

- When its stock was floundering in 2020, Acreage Holdings was able to raise debt with the credit arm of an unidentified institutional investor, for up to $100M; as opposed to further diluting equity at their weak stock prices at the time.

- Chicago-based MSO Green Thumb Industries raised $217 million through the issuance of senior secured debt to retire existing senior secured debt and for “growth initiatives.” With an interest rate of 7% per year for the maturity date of April, 2024, Green Thumb describes this transaction as industry leading.

- Another Chicago-based MSO, Justice Cannabis, raised $22 million through a credit facility from Palm Beach-based AFC Gamma to build out a 72,000 sq. ft. cultivation/processing facility and acquire a dispensary in Ewing, New Jersey.

- Toward the end of 2020, Holistic Industries, a U.S. privately held, vertically-integrated cannabis company, closed an oversubscribed round of $35M in debt for expansion and the potential of acquiring distressed assets.

- In March 4Front of Phoenix raised $6.5 million in sale-leaseback deal with Innovative Industrial Properties for a property in Illinois, with an additional $45 million to build out 558,000 sq. ft. of cultivation.

- HEXO Corp. (TSX: HEXO)(NYSE: HEXO) closed a public offering of $360 million principal amount of senior secured convertible notes maturing May 1, 2023. Proceeds will fund the $331 million cash payment in HEXO’s $766 million acquisition of Redecan in Ontario, the largest private Canadian LP.

The Growth of Funds Dedicated to Cannabis Financing

Also bringing fresh capital to the industry are funds dedicated to supplying financing for equity and debt transactions.

Toward the end of 2020 Intrinsic Capital Partners formed the fund Intrinsic Health Partners, LP, a $102 million growth equity fund formed to invest in life science and technology companies that are focused on the cannabis and hemp industries. To date Intrinsic has provided $65 million in funding for four non-plant touching portfolio companies.

Tysons, Virginia-based Altmore Capital, a senior secured debt lender closed its first cannabis debt fund exceeding its goal of capital available for lending by over 200 per cent. This new fund will be made available to plant-touching operators with more than $10 million in revenue. The fund is projecting the potential of increasing financing to single operators and MSOs by $200 to $300 million in 2022.

The booming marketplace in 2021 is generating renewed interest in cannabis commercial (CRE) investments. Not only are more debt funding options becoming available to cannabis operators, but also how well the cannabis industry performed during the COVID-19 crisis has shown traditional financing sources and formerly reluctant landlords that the cannabis industry exhibits recession-proof qualities. Neglected store fronts in formerly derelict areas and industrial warehouses continue to escalate in value brought on by industry expansion, particularly into areas dedicated as Green Zones within municipalities.

A Green Zone is an area designated where legal cannabis/cannabis-related businesses are allowed/encouraged to set up cultivation, manufacturing and retailing facilities. One funding resource, Canna-Hemp Debt Fund , estimates that industrial warehouses they are underwriting that are “green zoned” show at least a 20 to 30% in increase value. For debt loans the company feels comfortable with LTVs of 60-65% in their green zoned properties. For investor security, and to be able to offer lower than market rates, personal guarantees and cross corporate guarantees, wherever possible, are required from their borrowers.

And, the cannabis investment firms Mazakali and Satori Investment Partners have formed a strategic alliance for investing up to $20 million for investments ranging from $500,000 to $5 million in cannabis operators and cannabis-related businesses.

SPACs in Cannabis

While capital is flowing more freely into cannabis the national legal status continues to keep many VC and PE investors, as well as virtually all institutional investors, away from the industry. This puts the use of SPACs in the limelight for cannabis companies in the U.S. and in Canada to access capital over traditional sources and in order to pursue the path of going public. In fact, SPACs are bringing substantial liquidity to maintain sales growth and provide cannabis companies with the competitive advantage of more quickly getting to market. In many cases the SPAC merger process with a target company, termed to “de-SPAC,” can take place in a substantially shorter period of time than the traditional IPO timeline. That said, a targeted company must be ready to accelerate to public company complex accounting, financial reporting and compliance requirements. And, this must be accomplished in a relative short period of time – the two-year requirement for all funds to be invested or, if not, returned to investors. This requires a strong, experienced management team to perform due diligence on targets, and help market a deal to PIPE investors. Often it is the case that the acquisition target does not have financial records that measure up to investor scrutiny. In the final analysis, the most important factor in decisions about a SPAC investment, therefore, is the caliber and trust embodied in the senior management of the SPAC.

Investor Takeaway

There is no denying the explosive growth of the cannabis industry which now has capital flowing in at a record pace. Through May, capital raised in the cannabis industry totaled over $6.6 billion, compared to only a little over $2.3 billion during that same period in 2020. The industry is, in fact, transitioning – from its volatile beginnings just a few years ago to becoming more like a traditional CPG marketplace. And this is even before Big Tobacco and Big Pharma get more deeply into the industry to bring their level of professional management to cannabis operations. While many VCs and virtually all major institutional investors are still on the sidelines until federal legalization takes place, alternatives to accessing capital have arisen in the form of equity funding, debt lending and the public market through strategic acquisitions by/alliances with Canadian pubcos; and, with the growing presence of SPACs in cannabis. In the face of all this potential investor due diligence is still the watchword and experienced advisors are still the best guides through the innovative investment opportunities now becoming available.

Next Step – Category Expertise Needed

With capital finally flowing more freely into the cannabis industry there is no better time to establish your position and get your targeted business to come out a winner among those destined to struggle for survival. A talented deal team with not only alternative financing experience, but also direct experience in cannabis is essential. Expectations for performance are important to clarify at the beginning of the process along with a clear understanding of the compensation the advisors will receive for the extensive services rendered. At Highway33 Capital Advisory we stand ready 24/7 to provide the guidance our clients seek.

How We Can Help

The critical factors in assessing the potential of the array of funding opportunities in the industry still rely on careful execution of the basics of investment analysis:

- Due diligence for understanding the full scope of the business in the industry segment being targeted.

- Analyzing the preemptive nature of the target’s business model.

- Determining the soundness of the financial statements, particularly in cases where they are yet to be audited.

- And assessing the zeal of the team charged with the task of growing a company into a multimillion-dollar operation.

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.