The Rise of M&A in Cannabis Avoiding Pitfalls in Cannabis M&A Deals

2021 is becoming the most lucrative year in the history of legal cannabis in the U.S. With public support for legalization and states coming out of the pandemic in their own panic for increased tax revenues, funding is now flowing into this capital-constrained industry. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion this year, $84 billion by 2028.

And, as reported in previous issues of the EDGE Briefing, leadership to market dominance typically does not happen by slow, steady organic growth. The May 10th announcement that Trulieve is acquiring Harvest in a $2.1 billion deal to form the world’s most profitable multi-state operator (MSO) is substantiation. YTD 2021, over 144 transactions have been announced or closed, compared to 32 in the same period last year. The ever-increasing volume of Mergers & Acquisitions began to surge in Q4 last year when over $600 million in M&A transactions were announced. Consolidation and mega-deals have already set the tone for 2021. MSOs are leading the charge in the U.S. by having achieved scale, cleaned up their balance sheets and stockpiling dry powder for roll-up acquisitions. These MSOs are now acting more like CPG companies in the maturing cannabis market. Avoiding Pitfalls in Cannabis M&A Deals

In Canada, investors want strategic ways to gain greater access to the U.S. cannabis market. M&A transactions, as exemplified by the pending Aphria-Tilray reverse acquisition, are expected to play greater role.

The valuation model for acquisitions in the cannabis space is evolving from one based on sales, typically associated with emerging growth industries, to a more mature industry model based on profits or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) which justifies the evolution away from a sales-driven model. Avoiding Pitfalls in Cannabis M&A Deals

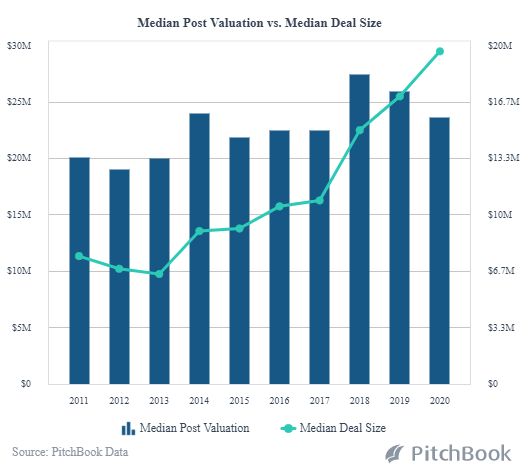

Sources like Pitchbook, for one, project deal size and post valuations will be on the rise.

And all this is even before Big Tobacco and Big Pharma get more deeply into the industry to bring their level of professional management to cannabis operations.

All Sunny Skyies for Cannabis M&A?

As pointed out by consultant Todd Wheeler in greenflower.com, history is replete with high-stakes M&A failures. He reminds us of such examples such as Fort Motor Company having to cut their losses with Volvo and Jaguar. And he singles out the infamous case of Sprint purchasing Nextel for $35 billion in 2005. Eight years later Nextel went out of business and recently Sprint is no longer with us either, after an acquisition by T-Mobile.

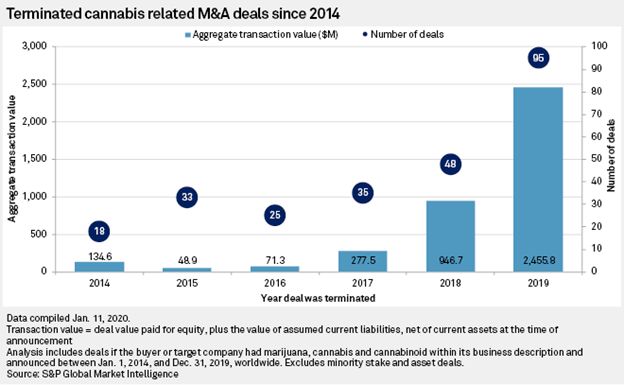

The latest figures we can find on the impact of M&A miscues on the cannabis industry come from SP Global Market Intelligence from research done by cannabis research firm New Frontier Data. In 2019 it was found that companies/investors backed out of 95 M&A deals valued at $2.46 billion.

Granted 2019 was a volatile year with increased regulatory scrutiny of cannabis M&A transactions, collapsed valuation of many Canadian pubco’s, the chilling vaping-associated pulmonary injury (VAPI) cases, some deadly, that shook the vape segment of the industry, among other challenges. This data simply points out that effective due diligence is required today as the stakes in each transaction continue to go higher.

In California, What Could Possibly Go Wrong?

Let’s take California as an example. The Harris Brecken law firm points out key considerations for that state that are likely to apply in other ways – due to the nature of state-by-state regulation of the cannabis industry – to other states as well.

- Local Knowledge – A must in the M&A process in cannabis, particularly as it applies to California, begins with a thorough familiarization with state and local regulations and their requirements.

- California Licenses Cannot be Sold – neither sold nor transferred in any way. The pertinence of this to M&A transactions is that it’s common practice in M&A deals in general for a form of security from the buyer to be offered to legitimize the proposition. Licenses in California cannot be used as such security because they cannot be transferred, therefore, not pledged as security.

- When Acquiring of a Parent Company – be advised that at least one California cannabis jurisdiction requires identification of equity and non-equity “owners” all the way up the chain to the parent company and has the discretion to require those persons to make full ownership disclosures.

- Complete Changes of Ownership at Once are Forbidden – at least one original owner must remain on the license while the incoming owners are evaluated. In M&A transactions the tactic of phased deals, where only portions of a business are transferred to the buyer at one time, is a tack often being taken here. This is probably the biggest area where failure to consider regulations at the outset could result in a lost license.

Additional Complications Avoiding Pitfalls in Cannabis M&A Deals

Other basic aspects of M&A transactions that need scrutiny according to Marijuana Business Daily are:

The Purchase Price – With deals being primarily cash and stock, sellers need to perform due diligence on the stock they are getting.

If the buyer is public, the sellers should know when (under securities laws) and how the stock may be sold (will the broker execute a trade in a cannabis stock?).

If the buyer is private, the sellers should consider doing due diligence on the buyer.

Change of Control – In cannabis this means that most state and municipal regulatory agencies will require some sort of vetting and approval for the change in control.

Legacy Liabilities – In an M&A transaction, unlike in a simple asset acquisition, a buyer does not have the luxury of picking and choosing assets. In cannabis the acquirer needs to conduct due diligence into the true nature of the sellers finances, which can often be unaudited.

Handling Debt – In the case of the cannabis industry a distressed company cannot file for bankruptcy protection in order to restructure its debts to become an acquisition target. This puts additional pressure on the buyer to avoid creditor lawsuit entanglements.

Sorting Through the Right Investment to Meet Your Portfolio Strategy

For our clients, here is the advice we provide as they assess M&A opportunities in the cannabis industry: Avoiding Pitfalls in Cannabis M&A Deals

- Know what the organization is getting into – Detailed due diligence and proper integration planning are crucial to identifying potential issues. What is the long term plan? This is particularly significant in the cannabis industry because, as we mentioned, bankruptcy is not allowed for cannabis businesses.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a measurement process for performance milestones in order to determine the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Time Kills Deals – That being the case, your advisors, lawyers, accountants and other stakeholders must realize that the price and terms of a deal don’t get better over time, and “negotiation exhaustion” kills deals.

- The Only Thing Constant is Change – Target markets and target consumers change rapidly over time. Fingers must be kept on the pulse of the marketplace for the intended goods and services of the merger so that expectations from the beginning of the process remain attainable at close.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there; how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

What’s It Really Worth?

Once it is confirmed that legal/compliance requirements are met then the next major step is conducting a realistic valuation of the business. Your investment banking intermediary will develop financial models to include the most important fixed and variable financial factors that will be the most important components in determining the value of a company. There are, of course, significantly different financial factors to consider for different companies, particularly complex in highly regulated industries such as cannabis. In the cannabis industry your advisors must positively understand the idiosyncrasies in this marketplace in order to identify a valuation range that ensures the buyer is not overpaying and that the seller’s proformas are verifiable.

What It Takes to Make It Over the Finish Line

- The Vision of the Parties

- All stakeholders to the M&A transaction must have a clear vision as to the direction toward profitability the marriage of the parties will take. This requires good advice about the fundamental legal and business issues that will arise and the judgement calls that will have to be made during the process to keep a clear vision for the post-closing entity.

- Commitment

- Once the decision is made that a buyer’s objectives are better served by acquiring rather than taking the path of organic growth, all key management team members must fully buy into that direction regardless of hurdles that will arise along the way.

- Culture Comprehending ESG – The Critical Role it Plays in Realizing the Value in an M&A Deal

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

- A critical component of the very essence of the deal is the shared values and behaviors in Environmental, Social, and Governance (ESG) that shape employee experience, interaction and morale within an organization. Understanding the Culture Equation avoids differences that are likely to become too hard to manage after the transactions is completed.

Where to Look for Help with the Process

We won’t belabor the subject, but what’s presented below is the case that a middle market investment baking resource like ours can add the value of expertise in the conduct of the cannabis M&A process.

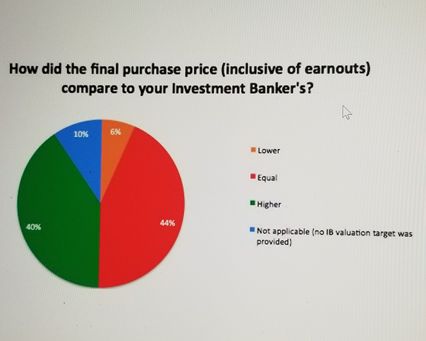

Some of the latest data we have on the contribution that an investment banking intermediary makes comes from a 2016 research survey by Professor Michael McDonald, of Fairfield University. The survey, “The Value of Middle Market Investment Bankers,” questioned 85 business owners who used an investment banker to sell their businesses for between $10 million and $250 million during the period from 2011 to 2016. The Fairfield University survey cited above concluded that 84% of the respondents definitely felt that investment bankers added value to the sales transaction. Meaning that the final sales price was equal to or higher than their initial sale price expectation. Avoiding Pitfalls in Cannabis M&A Deals

The survey examined eight areas where business owners could find value in the services of investment bankers:

- Preparing the company for sale – implementing changes if other elements in the business that would enhance its value.

- Managing the M&A process and strategy – from creating teasers about the opportunity to their investor base to managing the data room and negotiating key terms leading to a final agreement.

- Identifying and finding the buyer – from researching their network/database for the qualified buyers whose investment strategy best fit seller’s objectives.

- Adding credibility to the seller – ensuring buyers that they are entering into a reputable process.

- Coaching the owners – guidance through the often arduous process, avoiding pitfalls common to inexperienced sellers.

- Enabling management to focus on running the company during the sale process.

- Negotiating the transaction – negotiating LOI terms for the benefit of both parties to the transaction.

- And, structuring the transaction – a structure that maximized buyer’s profits and minimizes seller’s risk.

From the examination of these 8 factors it was concluded that “managing the sale process” is the most valuable service provided by investment bankers. In fact, the top three among these factors were: “managing the M&A process & strategy”, “structuring the transaction”, and “educating and coaching the owner.”

For our clients, once the vetting process is completed the outreach process begins to all potential qualified acquirers. Our contact list numbers in the tens of thousands of PE firms, MSOs, Pubcos, HNW, Family Offices and other qualified investors. They are contacted, sign our non-disclosure agreement, are supplied with an Executive Summary about the opportunity and invited for a full presentation of an informative pitch deck and financials.

Investor Takeaway

2021 is becoming the most lucrative year in the history of legal cannabis in the U.S. The majority of states now have medical and, in many cases, adult use legalization in place and sources like Grand View Research project a US industry size of $33 billion this year, $84 billion by 2028. Along with this market growth is the ever-increasing volume of M&A transactions in the industry. YTD 2021, over 144 transactions have been announced or closed, compared to 32 in the same period last year. With that comes the danger of pitfalls in a successful deal in such a complicated industry; an industry subjected to state-by-state regulations while still being illegal federally. A significant hurdle In the State of California, for instance, is that an M&A transaction requires identification of equity and non-equity “owners” all the way up the chain to the parent company, with the potential of requiring those persons to make full ownership disclosures. In the final analysis after all the nuances in the cannabis industry, processing a cannabis M&A transaction across the finish line involves the vision of the parties, the commitment of all stakeholders involved, and the successful blending of the cultures of the merged companies. And in the terms of where to look for guidance in avoiding the pitfalls of this complicated industry a university study found that among executives on the sell-side of transactions recognized their investment bankers for the value added in “managing the M&A process and strategy.”

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.