Investor TakeawayCannabis Industry Turns to M&A Over Equity Raises – Part II

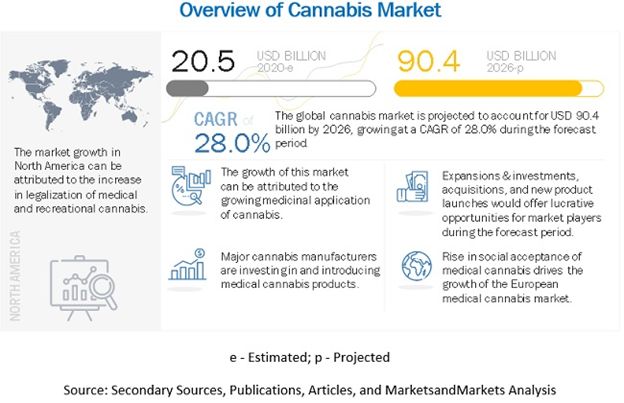

The flawed cannabis industry is nevertheless rapidly becoming the largest CPG industry – in the world! MarketsandMarkets projects a $90.4 billion worldwide market size by 2026, with a 28% CAGR along the way. Still in its growth phase, consolidation continues to be the watchword in the industry into 2022. In this week’s issue of The EDGE Briefing we conclude:

- Prominent MSOs remain bullish on consolidation opportunities, regardless of the pace of federal re-scheduling.

- In general M&A transactions exhibit these common characteristics: Virtual M&A, More focus on ESG, much more Deal Activity.

- M&A is now exceeding the pace of equity financing in the cannabis industry.

- This is due to the enormous gap in enterprise value/EBITDA multiples between large and small companies made it easy for acquisitions to be accretive.

- Ground has been broken for institutional investors to enter the space by the investments of the first hedge fund.

M&A is the most likely foundation for sustained industry growth, even potentially including de-risking a cannabis strategic investment.

Conclusions from Part I Cannabis Industry Turns to M&A Over Equity Raises – Part II

In Part I of this two-part series we pointed out last week that worldwide, the pace of M&A transactions for industries in general is exceeding the record pace set in 2021. The same is true for global and U.S. cannabis transactions. In fact, M&A is exceeding the pace of equity financing in the cannabis industry.

- MSOs turn to debt and M&A because – according to analysts’ cash-flow estimates for 2022 and 2023 – the large MSOs are already well funded. Cash balances are high, and 2022 and 2023 expectations are for positive free cash flow.

- As a result, M&A activity will increase in 2022, as large cannabis businesses will have the means to acquire smaller competitors.

- Transformative M&A transactions to continue.

For strategic investors finding investment opportunities in the path of the MSOs’ search for M&A targets of opportunity is key.

The Market

While the cannabis market experiences struggles, particularly with stock volatility of the public MSOs, there remains no denying the upside opportunity. According to MarketsandMarkets, the global cannabis market is projected to reach US$90.4 billion by 2026, recording a CAGR of 28.0% along the way.

And, as reported in Part I, capital creation through M&A will continue to increase in 2022.

The Torrid Pace of M&A Transactions Globally

On a global basis and for industries in general M&A Science Newsletter predicts that M&A activity in 2022 will continue the torrid pace set in 2021. The Newsletter reports on the findings of a recent Deloitte survey, The Future of M&A Trends. The survey found that “… deal frequency and amounts are expected to increase even further as companies are looking for more transformational change through transactions.”

Characteristic of these transactions are these factors:

“Virtual Diligence” is speeding up the process of M&A. Driven by investor, consumer and employee demands, “Environmental, Social, and Governance (ESG) investing isn’t new, but the pandemic has throttled it into the forefront of transactions and will likely influence deal-making – improving ESG credentials through acquisitions.”

And “We,” as the survey and the M&A Science Newsletter conclude, “have no current evidence that M&A activity is slowing down. It could very well surpass the record-breaking year of 2021.”

MSOs Dominate the Equally Hot Pace of M&A in CannabisCannabis Industry Turns to M&A Over Equity Raises – Part II

Bloomberg cites statistics from research firm HUB International that the U.S. cannabis industry broke another sales record last year – $24 billion. Regarding this continued hot pace of industry growth HUB concludes:

As a result, M&A activity will increase in 2022, as large cannabis businesses will have the means to acquire smaller competitors. What’s more, expect Canadian cannabis companies — unburdened by federal restrictions — to increase their cross-border mergers and acquisitions.

An analysis by MJBizDaily found that M&A is exceeding the pace of equity financing in the cannabis industry. They attribute this to these factors:

- Usually Equity and M&A fund the industry at the same pace. Why have they disconnected?

MJBizDaliy cites reasons such as these:

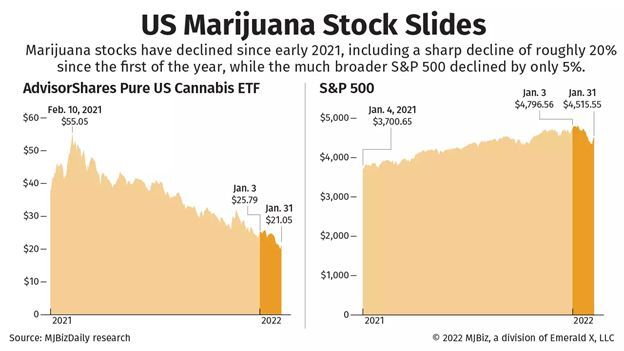

The enormous gap in enterprise value/EBITDA multiples between large and small companies made it easy for acquisitions to be accretive.

Acquisition targets have been happy to accept MSO stocks at current discounted levels because they perceive significant upside.

MSOs have found it easier to enter new markets by acquisitions rather than building from scratch.

- Equity financing is down.

There is no question that the stock prices of the large publicly traded MSOs continue to decline…

…as MSOs turn to debt and M&A because – according to analysts’ cash-flow estimates for 2022 and 2023 – the large MSOs are already well funded. Cash balances are high, and 2022 and 2023 expectations are for positive free cash flow.

MJBIZ Daily concludes: We also expect transformative M&A transactions to continue.

Significant M&A Transactions

Robert Hoban of IRGlobal cites two key examples of fast paced M&A activity. On March 23rd, Cresco Labs completed the acquisition of Columbia Care, making Cresco the largest MSO by proforma revenue ($1.4B). The new entity now has operations in 18 U.S. legal markets with 130 points of sale.

The next day, Hoban points out, Incannex Healthcare Australia acquired Dutch medical cannabis company APIRx Pharmaceutical BV for $93.3M. As to the significance of these acquisitions, Hoban says:

These two deals highlight trends that we have seen over the past several years which suggest that North America’s industry development (and corresponding M&A trend) focuses on effective adult-use distribution and access to the largest cannabis global consumer base with a focus on revenues and post-prohibition positioning.

Common Themes In MSO M&A strategy

And from the senior executives of the major MSOs represented at the recent Benzinga Capital Conference we found these common themes are at the root of their M&A strategies:

- The first is that all acknowledged that developing strong brands is crucial in order to lead the industry into its inevitable CPG future.

- The second is the vital support each MSO intends to provide the Social Equity programs in each of the states in which they do business, while they also pursue effective ESG policies within their own organizations.

- And the third is echoed by all the major MSOs at the conference; that restructuring their company’s finances places then in the position to take advantage of acquisitions and debt financing.

Approaches to Financing Cannabis Consolidations

“The First” Institutional Investor Jumps In

At the recent Benzinga Capital Conference Ricky Sandler CEO, CIO & Founder, Eminence Capital LP, revealed his strategy as the first and only hedge fund institutional money in the cannabis space. Now that hedge funds have come back to a world of basic fundamentals, valuations and deep research, he has found, “public cannabis MSOs to be the greatest representation of this that I have seen in the last 30 years.”

While I may be the first, I think over the next 3 to five years most of my peers and the big money is going to be in this space.

Sandler’s investment philosophy is expressed as owning really good, durable, growing cannabis businesses with mispriced stock – stock that he can understand why it is mispriced. He clarifies the nature of risk in cannabis stock by saying, “Most people don’t understand investing in the stock of public MSOs you are actually buying registered securities, secondary shares, you are actually not even directly funding the business of the companies.”

De-risking Cannabis Investing – Leading to the First Can-Am MSO

Paul Lufkin, Executive Chairman United Global (CSX:FIOR OTC: FIORF), is employing the strategy of de-risking cannabis investment through consolidation in mature markets while and building the first Can-Am MSO. Now having gone through their own merger with Fiore Cannabis they are working on the 1500 entrepreneurial cannabis companies in Colorado, Oregon and Canada to consolidate in what Lufkin describes as, “a publicly traded, private equity company for cannabis, we’re consolidating, diversified, multiple companies. In two countries, and five markets.”

That’s how we de-risk our investments, a cross border multi market ability with profits.

Consolidating in mature markets into a salable public company. We are a collective in which you keep you own brands.

The collective in which everybody down to the budtender gets stock is bound together by a common ESG culture and the drive for profit.

How We Can Help – Finding the Right Fit for Your Investment Strategy

What we conclude from the perspectives provided by the largest of MSOs is that 2022 offers an array of opportunities in M&A transactions, of all sizes, and in non-dilutive debt financing. What we advise our investors as they assess the market in which they see as the most advantageous boils down to clarifying the investment needs and objective of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity; the right operators whose objectives and scalability are a fit for investors’ portfolios.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.