Investor Takeaway Cannabis MSOs Battle for Differentiation

In an industry growing at a record pace to become THE leading consumer products industry – in the world, Multistate Operators (MSOs) have become dominant. Some have even doubled revenue 2021 over 2020. Still the stock of publicly traded MSOs has been underperforming for over a year now. While there are many factors that we have reviewed in previous issues of The EDGE Briefing, we turned to hear from key industry executives at the recent Benzinga Capital Conference to get a first-hand perspective on the plans the largest MSOs have to differentiate themselves in the marketplace in their quest to bolster shareholders, strengthen their bottom lines, and pursue M&A growth strategies. We found that building strong brands, supporting Social Equity programs and benefiting from debt financing now that balance sheets have been restructured were common themes among the major players. Cannabis MSOs Battle for Differentiation

Stock Performance Below Potential Cannabis MSOs Battle for Differentiation

MSOs dominate cannabis sales. Results measured by MJBizDaily show that while EBITDA is still illusive in most cases, dramatic revenue increases by the leading MSOs were achieved last year.

Behind the numbers, almost double 2020 revenue in some cases, MSOs were solidifying their growth strategies, cleaning up their balance sheets and engaging in a race to make the most significant M&A transactions. Cannabis MSOs Battle for Differentiation

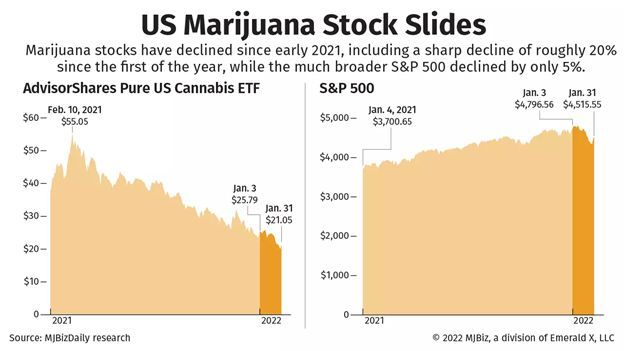

On the other hand, we have been reporting on the dismal stock performance of the publicly traded MSOs that began after Q1 2021. Since then, stock prices as measured by the performance of the S&P 500 have continued to slide, while the general trend of that index had been upward. Cannabis stocks have declined by another 20% since the first of the year compared to only a 5% dip in the index in general. Cannabis MSOs Battle for Differentiation

This can be attributed to a number of factors ranging from the taxes that take their toll on these businesses that are subjected to the restrictions of Section 280E of the IRS tax code, to the continuing trend of only modest growth in cannabis sales overall. One of those factors over which cannabis operators have no control is the progress of de-scheduling through Congress. As noted by Richard Carleton, CEO of the Canadian Stock Exchange, “every time we see positive movement, a setback in public expectations about the timing of U.S. federal de-scheduling is reflected in stock performance – most often unrelated to actual company financial performance in the marketplace.”

MSO Differentiation Strategies

In lieu of these challenges in the financial markets and continuing challenges to the growth of MSOs, we turned to interviews conducted at the Benzinga Capital Conference last month to get a first-hand perspective on the plans the largest MSOs have to differentiate themselves in the marketplace in their quest to bolster shareholders, strengthen their bottom lines, and pursue M&A growth strategies.

Curaleaf Goes National

With over a $4 billion market cap, Curaleaf is by far the largest MSO in the cannabis industry. Their strategy was discussed at the Benzinga conference by Matt Darin, President of Curaleaf U.S. With a footprint covering 23 states, the objective of Curaleaf is to be dominant nationally. Darin stated that the roots of their business are in the limited license states in the Northeast; states where the company can have vertical integration opportunities and solid margin profiles. They look for similar profiles in the mid-west, and feel they must maintain a strong presence in the more mature markets of California, Colorado and Michigan. Even though these markets don’t offer the margin profiles or the supply and demand dynamics of markets such as Illinois and New Jersey, Curaleaf watches the tends coming out of the West Coast that they could apply to the East Coast.

Curaleaf’s Executive Chairman of the Board, Boris Johnson, further explained the firm’s business strategy by saying, “I see this as an omnichannel business much like Coca Cola. I want to distribute our brands in as many points of sale that we possibly can.” But for the foundation principle that Johnson seeks for differentiating Curaleaf from the competition, it’s all about terpenes. ‘It’s going to be about flavor. Its going to be about the effect of the terpenes, the entourage effect of the terpenes, So I believe genetics are a very important part of the business.”

You are going to hear from us shortly about investments we are going to make in that area. Because we think that is the future. Owning the genetics, owning the effects of those genetics, building up our seed banks so that we can provide different flavored products for our customers on a regular basis, with variety and consistency.

Setting his sights on formulated products, rather than flower, to deliver on this promise to the consumer Curaleaf will continue to introduce new products to the industry. “Last year, says Johnson, “11% of our revenue came from products that were new to the industry. This year we are targeting 15%.”

Tilray Seeks Strength in Brands, in Diversification

Tilray Brands, Inc. CEO Irwin Simon says the name is “Tilray Brands.” In Canada he predicts the company will get to be a billion-dollar business by basically winning share and with future acquisitions. “Because we cannot own anything in cannabis is the U.S.,” he says, “our plan is to buy spirits businesses, beer businesses, food adjacency businesses, because one day legalization to some extent will happen. And ultimately, they are brand names. And the name of our company is Tilray Brands and I am about building brands and how brands will differentiate from just selling cannabis. His vision for the company is to be a global, diversified company that has a lot of experience in building brands.

We have a strong management team, a strong board that is built around ESG and good governance. I have been part of a company before that’s built a $3 ½ billion company. So when you bring it all together, and with a lot of good luck, we will get there.

What Simon laments that he can’t control are the politicians. That still remains the unknown quotient in the industry. That’s why he aspires to make sure Tilray Brands is diversified and achieves sales and EBITDA; being profitable while giving back to shareholders and consumers.

Jushi Holdings Targets Acquisitions in Emerging Markets

According to James Cacioppo, CEO, Chairman and Founder of Jushi Holdings, the key phrase for the acquisitions trail they will be on this year is “track record.” “As a hedge fund guy,” he says, “you can’t manage peoples’ money and get to multibillion dollars if you don’t have a track record, and in cannabis you shouldn’t invest in companies that say they can do M&A if they don’t have a track record. We have a track record and have attracted some of the most sophisticated investors in the industry.”

Jushi will be looking to expand in emerging markets with favorable regulatory developments to advance to adult use from medical. In Ohio, Cacioppo sees adult use coming on the state ballot in November. Virginia is scheduled to go to adult use in 2024, with Jushi having worked with the state to improve a restrictive medical program and having begun the process of preparing cultivation buildout to meet the anticipated demand for adult use. In Nevada they will be looking to acquire more dispensaries. Jushi will be looking for similar growth in Illinois and acquisitions in markets like Mass where deals are in the range of 2x EBITDA. Cacioppo sees no reason to get into states where prices have gone to the 4x to 7x EBITDA as he has seen some competitor do. He is also bullish to be in the hunt for acquisitions since he feels that Jushi is one of the few major players left that still has dry powder to pursue evolving acquisition targets.

The Turnaround of Acreage Holdings

The transformation of MSO strategy can be no better exemplified than by the evolution of Acreage Holdings. Also a speaker at the Benzinga Capital Conference last month Peter Caldini, CEO of Acreage, related common themes that other prominent MSO executives at the conference expressed. The Acreage turnaround has been driven by these factors:

- A new leadership team with commercial experience – experience in scaling businesses in highly regulated industries.

- Operational and financial disciplines requiring divesting underperforming assets.

- A portfolio strategy focused around core markets.

- That strategy now positions Acreage to take advantage of significant opportunities in the 8 core states of their 10 state portfolio.

- A portfolio that includes key states New York and New Jersey. Acreage is one of 10 licenses in NY, with adult use anticipated for the first half of 2023.

- Their 3rd priority state, Ohio, is medical now with an adult use initiative anticipated on the ballot in the fall.

- In Tier 2 markets, such as Massachusetts and Pennsylvania, Acreage is positioned in the premium segment of those markets.

- The reason they are not seeking to open in the Florida market is that they feel there is limited ability to scale there without eating up a disproportionate share of resources.

- Rightsizing by reducing as much as a 50% staff reduction has improved the overall efficiency of the organization.

- The primary growth objective now is to compliment organic growth with M&A opportunities within their existing footprint.

Common Themes Among the Competitors

There were common themes we found that are at the root of the strategies expressed by these leading MSO executives.

- The first is that all acknowledged that developing strong brands is crucial in order to lead the industry into its inevitable CPG future.

- The second is the vital support each MSO intends to provide the Social Equity programs in each of the states in which they do business, while they also pursue effective ESG policies within their own organizations.

- And the third is echoed by all the major MSOs at the conference; that restructuring their company’s finances places them in the position to take advantage of debt financing.

How We Can Help – Finding the Right Fit for Your Investment Strategy

What we conclude from the perspectives provided by the largest of the MSOs at the Benzinga Capital Conference is that 2022 offers an array of opportunities in M&A transactions, of all sizes, and in non-dilutive debt financing. What we advise our investors as they assess the market in which they see as the most advantageous boils down to clarifying the investment needs and objective of all parties, determining the real value in the business by calculating a well-substantiated valuation, and matching the right investors with the right funding opportunity; the right operators whose objectives and scalability are a fit for investors’ portfolios.

At Highway 33 Capital we excel at structuring deals to meet client investment strategies in emerging 2022 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.