Investor Takeaway Will Cannabis Debt Financing Survive Rising Interest Rates?

Debt financings reached 44% of total dollars raised in the cannabis industry in 2021, up from 38% in 2020. Improving operations in the low interest environment last year spurred debt funding growth. Continuing multimillion-dollar debt transactions among cannabis industry leaders shows that debt as a source of growth funds is a rational use of capital, not a sign of business distress. For cannabis operators debt can play a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. Where is the industry headed in view of the interest rate increase by the Fed last week? Should you ride out this latest storm in the cannabis industry or lock in rates NOW? For additional guidance we have summarized the opinion of industry lending experts at the Benzinga Capital Conference. We found them continuing to be bullish on the role debt financing will play in the industry, and we conclude that the most assured time to lock in rates is NOW.

The Cannabis Financial Marketplace Will Cannabis Debt Financing Survive Rising Interest Rates?

While mergers and acquisitions remain the dominant way to accelerate growth among the bigger players in the industry, Cannabis Business Times reports the volume of debt financing. They cite the Viridian Research data that Debt financings reached their highest percentage level since we began tracking these stats, reaching 44% of total dollars raised in 2021, up from 38% in 2020. Debt capital raised increased to $5.62 billion in 2021 from $1.65 billion in 2020. Seven of the largest 10 capital raises of the year were debt transactions.

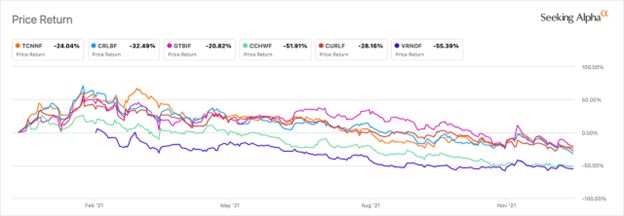

This came at a time when they found that as the de-scheduling buzz wore down, stock began their steep decline – 51% below their peaks by the end of the year with equity issuance following the downward trend.

The saving grace according to the Viridian analysis for cannabis capital was a newly invigorated debt market, fostered by the entrance of new institutional capital and riding on the improved profitability of the industry – at least in the U.S.

Professional Management Capital Comes to Cannabis Will Cannabis Debt Financing Survive Rising Interest Rates?

Toward the end of last year the industry reached a turning point in access to capital. In 2019 a syndicate of lenders provided Curaleaf with a $300 million term loan. At the time, this was the largest and most significant debt financing an MSO was able to negotiate. Then, last year Curaleaf set another record by receiving commitments for a privately placed debt raise of $425 million, once again securing the largest debt raise to date, but also obtaining an 8% interest rate – perhaps the lowest rate in the cannabis industry at that time. At the Benzinga Capital Conference last month Jack Mascone, the Head of Capital Markets for Seaport Global, who spearheaded these transactions provided the facts behind the headlines.

Mascone sees more significance for the future of the cannabis industry than just the milestones of these Curaleaf transactions. In the 2019 deal two-thirds of the participation in the $300M loan was from family offices and non-institutional investors. When the deal was refinanced last fall, at that low 8% rate, more than 75% of the funding came from what Mascone considers as institutional and professional investment capital. “The migration of new participants into the cannabis market, particularly on the debt side, is prolific and it’s going to continue to lower everybody’s cost of capital,” he says.

Having said that, today not every private and public borrower in the cannabis sector has assess to those kind of investors. Better companies currently do. And the real story here from a macro perspective is that the structures you can get in this sector – notwithstanding how nuanced, how difficult it is to underwrite, are very attractive relative values for lending opportunities for institutional investors. That is going to be the case for a while and I think that as investment professionals see the inevitability of some form of SAFE, or something that permits more normalized lending activities, they are going to find a way into these deals. Not a straight line but it is going to benefit everybody’s cost of capital, particularly on the debt side.

Thanks to their stronger market position this is substantiation of the trend away from equity to debt financing of the major MSOs that are cleaning up their balance sheets and solidified their market expansion plans.

Debt Financing Options Will Cannabis Debt Financing Survive Rising Interest Rates?

Panelists on the subject of debt financing at the Benzinga Capital Conference represented these options:

The approach taken by Don Brian, CEO & Chairman of Freehold Properties, is to provide long term real estate financing using mortgage-with-purchase-option in favor of the company’s REIT. “This, Brain says, “provides both dialed-in financing based on the operator’s needs, and also the opportunity for investors to benefit from the upside of the appreciation of the real estate.” Freehold is a real estate lender, but they look first at the quality of the operator, then the real estate. They are focused on the better credits in the industry, so they prefer public companies, and large privates. Their strategy, find good operators then go long and deep with them in the space of the industry they are in and where they can grow their business. Brain says though that, “It’s tough to be in the middle of the intersection of illiquidity and illegality.” To keep liquidity flowing into the industry they have a public vehicle, because raising private capital can be difficult, offering both a coupon, essentially a dividend value, for investors as well as the opportunity for appreciation of equity value by owning real estate post legalization.

Steve Ham, Managing Partner Altmore Capital, is a cash flow lender. Their strategy is to look for great management team they can back. Ham say, “If they are not the kind of people you can have a beer with they are not good prospects. Because if things go wrong there are a lot of issues to be worked out with the management team.” Altmore deals start with the relationship and then the continued communications during the process of due diligence and ongoing review of financial documents. They look into the different types of collateral of the prospect that is needed to give Altmore’s investors asset coverage for protection.

John Mazarakis, Partner & REIT Executive Chairman of Chicago Atlantic Real Estate Finance, Inc., represents the hybrid opportunity by having a REIT on the public side, with cash flow lending on the private side. Their strategy simply expressed as looking to help companies that have ability to repay. Mazarakis echo’s the common theme among the other alternatives that “relationship is over 50% of what we consider.” Chicago Atlantic focuses on states east of the Mississippi – primarily the medical states looking to go to adult use. So, their primary criteria after establishing the relationship are:

- State

- Medical going to adult use

- Cash flow

- Collateral

Their differentiation, providing undiluted capital while declining valuations continue to lower the value of equity. “Debt is not sexy for investors,” he says. “Not going to make 10x, but we are the unicorns, we provide a 17.5% senior secured return, unleveraged. That’s unheard of in this space – on the REIT side and on the B2C side.”

The primary underlying reason for the rise of debt was that the low interest-rate environment in the U.S. economy attracted more debt providers to come online. And continuing multimillion-dollar debt funding among cannabis industry leaders shows that debt as a capital source for cannabis companies is a rational use of capital – potentially cleaning up balance sheets and enabling access to funding for expansion and/or the purchase of distressed assets coming out of the pandemic – to use debt financing for competitive advantage in the marketplace.

On the bright side for debt financing, Crunchbase recently reported the market could heat up as venture capital slows. Venture debt, no mater how it is defined, is giving companies cash they may need while not diluting the stakes of founders and shareholders. It can lessen the amount of more expensive venture capital needed and also lower dilution.

Crunchbase quoting David Allred, C.E.O. of Silicon Bank, “As equity capital becomes more expensive, interest in debt goes up.” “It’s always been a good tool against expensive equity,” he said. “It can prolong the life of that expensive equity.”

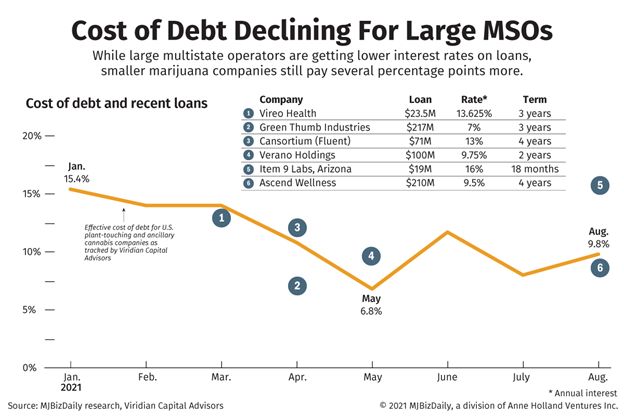

Prior to rising inflation and recent action by the Fed on interest rates, particularly for major MSOs, interest rates had been declining:

Federal Reserve Action and Cannabis Debt Rates

However, on May 4, the Federal Reserve raised its benchmark interest rate by a half-percentage, the largest increase of its kind in more than two decades. In addition,

the Fed outlined its plan to begin trimming its nearly $9 trillion balance sheet beginning in June; that is, bonds as part of COVID-19 economic stimulus measures. (Treasury and mortgage bonds comprise the majority of the Fed’s balance sheet.) What that means to the economy in general is heightened borrowing costs for mortgages, auto loans, credit cards and corporate loans. What will be the impact on the cannabis industry was also discussed at the Benzinga Capital Conference prior to this action by the Fed.

In the panel discussion, Don Brain, of Freehold Properties, expressed his concern that interest rates for cannabis companies may be at their low ebb. “I think legalization is further down the road than most people think,” he says, “and interest rates now are probably at their low point than they will be in the next 5 to 10 years.” He bases his concern on a survey by the Fed that interest rates could be up 400 to 500 basis points in the next 5 to 6 years. He feels that a lot of that pressure is going to come from investor expectations of return. They have been used to getting very low returns on debt. Now based on where inflation is they are looking for greater returns in the future in this space.

On the other hand, John Mazarakis, of Chicago Atlantic, states that given the fact that the cannabis industry is growing at a 20% rate and that it is an uncorrelated industry, “I think that interest rates will net-net in comparison to other mainstream industries; will have a lower impact on the cannabis side,” he notes. “ Cannabis is more resilient. We are in a net low environment and that environment is here to stay. But no one has a crystal ball.”

Steve Ham of Altmore Capital reminds us that the key to lending in the industry is the margin spread. And while that margin will tighten, the size and scope of the growing cannabis industry will continue to find more operators becoming cash flow positive. He cites this example of the relative size of the spread:

A company with $20M revenue and $4M EBITDA becomes a $60M company with $12M EBITDA. When you refi a loan from $7M in the first facility to $15M, the refinancing interest rates will go down as a result of credit quality becoming that much better. In a rising interest rate economy, you cannot tell how much that spread will compress but the good news is that the industry will continue to grow and become more cash flow positive.

In the final analysis, Don Brain concludes, “With the large states now moving from medical to adult use begins to show the maturation of some of the operators and their ability to bring branded product to the market which I think will provide some consistent profitability in the industry.”

What Can Strategic Investors Use as a Guide Through Debt Deals for the Right Investment to Meet A Portfolio Strategy?

We agree with the panelists that debt plays a vital role in the capital structure of a company in order to preserve equity and to facilitate long term growth. As our clients assess the potential of debt transactions, we provide these guidelines

For companies seeking debt, the following are key considerations:

- Most cannabis debt providers will require PGs from principals. This is always a tough decision for founders and one that carries real risk. Are you willing to PG the debt?

- What assets does the company have? Or is purchasing? Real estate, equipment, accounts receivable, other assets?

- Does the company have existing debt? And how much debt can the company take on while not taking undue risk with cash flow?

For investors who are considering lending to cannabis companies the following are key considerations:

- What are the credit scores of the principals? Is there any credit data on the company? How timely do they pay their payables, for example?

- What is the company’s existing cash flow? How realistic is the projection for future cash flow?

- How will the company use the funds? Is the use of funds realistic?

- What security will the investor have that they can recover funds if the loan isn’t repaid: PG? Cross-corporate guarantee? First lien on assets?

- Does the management team have the right experience for the type of project/company that they want to be?

- Does the company have its state and local cannabis licenses? If real estate is involved, what is the status of current local permits?

- Due diligence by experienced industry advisors is crucial since the lack of bankruptcy protection and restrictions on cannabis license ownership can complicate the debt financing transaction.

How We Can Help

At Highway 33, we see decision-making challenges daily in our role as an investment banking intermediary as we arrange for the funding of growth companies in the cannabis and hemp markets via M&A, asset sale/purchase, and debt transactions. Finding the right fit for your strategic investment portfolio, or the proper way to appeal to a source for your growth funding, comes down to:

- clarifying the investment needs and objective of all parties

- determining the real value in the business by calculating a well-substantiated valuation

- and matching the right investors with the right funding opportunity – the right operators whose objectives and scalability are a fit for investors’ portfolios

We excel at structuring deals to meet client investment strategies in emerging opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell-side or Buy-side client.