Statistics from StockDetect.com tell us that global cannabis sales this year will likely reach nearly $31 billion, an increase of around 41% over 2020. That breaks down to the U.S. accounting for $24 billion of that forecast, Canada $4 billion, with the international market accounting for the remainder. Cannabis is consumed by over 200 million people worldwide with legalization of medical marijuana now in 47 of 196 countries. Two of those countries, the U.S. and Canada, also allow Adult Use. In the U.S., 19 of the 37 legal states have also opened up for Adult Use. Over 270 million Americans reside in states that permit use of medial marijuana, nearly 100 million are in states that have also legalized Adult Use. Lessons Learned from Cannabis Stock Trading

Capital Flowing into the Industry

Crunchbase reports on the continued flow of capital into the industry finding that in the first five months of the year 132 funding events raised an average of $15 million each. In these last five months of the year the average transaction went up to $28 million in 73 funding events. (This includes funding from pre-seed through series D and post-IPO equity raises.) This compares to the average investment size that is up 165% over 2020. Lessons Learned from Cannabis Stock Trading

Crunchbase concludes:

Investments are getting larger across nearly all stages of cannabis investments. According to Crunchbase data, the average seed-stage investment for 2021 is $1.86 million, up 85% from the average size in 2020 of about $1 million. Series B and Series C checks are up 128% and 154%, respectively, with average sizes of $18.96 million and $101.67 million. One exception to the trend: The reported size of Series A investments are down 25% year over year. Even though the broader trend holds, there isn’t a distinct reason why that particular stage has fallen a bit behind.

Trading on Stock Exchanges

The stocks of a total of 126 cannabis companies are traded on exchanges around the world. The vast majority of those are, of course, traded in Canada and the U.S. The top cannabis stocks by market cap are Jazz Pharmaceuticals (JAZZ), Curaleaf (CURLF), Innovative Industrial Properties (IIPR), Canopy Growth (CGC), and Green Thumb Industries (GTBIF). The largest of the Canadian exchanges where the largest of the pubcos on which we have been reporting are traded is the CSE.

Lessons to be Learned from the Pubcos

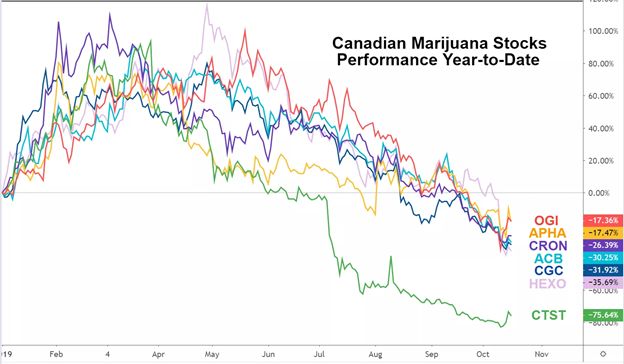

To say that shareholders in Canadian and U.S. publicly traded companies have been a wild rollercoaster ride would be a gross understatement. The off-the-charts inflated valuations in 2017 and 2018 based on future performance estimates (how good it was going to be), rather than on basic fundamentals, lead to the market come crashing down in 2018 and again in 2019. Even during this year, as the chart below shows, there have been high “highs” and the current low “lows.” Lessons Learned from Cannabis Stock Trading

Investing News Network (INN) summarizes the bubble burst of the Canadian pubcos with the truism that overvalued stocks crash sooner or later. In Canada overproduction relative to tepid demand caused large scale investments in cultivation and processing facilities to become underused and only added to the fiscal losses of the major pubcos. In their case, “over production kills stocks.” Nevertheless, INN summarizes:

Cannabis stocks are a good buy if you are in for the long term. Despite the bearish performance of the last year, the long-term viability and profitability of cannabis stocks can’t be ruled out. Compared to established industries that have been around for decades, the cannabis landscape is still in its infancy. Once regulators fix their red-tape issues and cannabis companies get beyond “too good to be true” valuations, cannabis stocks will get out of their current bearish trend.

What Fits and Starts of the Legalization Process Have Taught Us

There is no disputing the fact that the public is focused on the potential of the dramatic development of U.S. Federal legalization. You can see that clearly in the chart above that as the promise of the Biden Administration enacting legalization has waned, stock prices have responded on a steep downward trajectory. What these investors may not realize is that in this restrictive regulatory environment when access to cash is tight the larger cannabis companies can grow faster with a lack of competition and with lower rates to access growth funding. SubStack points out that Green Thumb, for example, is borrowing at the rate of 7% while smaller cannabis companies are stuck with rates at 15% or higher. At the same time these pubcos have the luxury of establishing barriers-of-entry to Big Pharma, Big Tobacco, and Big Alcohol, as well as Big CPGs, who all must wait on the sidelines for the advent of Federal legalization. As SubStack puts it: Lessons Learned from Cannabis Stock Trading

While cannabis stocks may be down, investors need to realize they are compounding their true value at an incredible rate right now. Cannabis investors could learn a thing or two from NIMBYism (Not in My Backyard) and slow regulatory movements. They add incredible value in the long term. To get really high, cannabis investors should want things to go real slow.

Lessons from the Gamestop Trading Frenzy

Marijuana Business Daily sums up the meteoric rise of GameStop’s shares in February as a “short squeeze” saying that the same thing happened to Tilray in 2018, Volkswagen in 2008 and supermarket operator Piggly Wiggly in the 1920s.

While it is possible to profitably invest by selling whatever is rising at ever-higher prices for nonfundamental reasons, it is a tough zero-sum game where, by definition, someone must eventually lose.

In Marijuana Business Daily MJResearch likens early emotional stock buying to a “voting machine,” while in the long run the stock market is actually a “weighing machine.” This means that the fundamentals that yield the profitability of a business determine the incremental return of the invested capital, the ROIC, which when used to expand high return projects accrues to the real benefit of shareholders. Most recently we have also seen the fad buying frenzy with cryptocurrency, blockchain, and AI. Stocks all hyped in a similar manner.

Lessons From A Cannabis Pubco Case History

In reporting on why first-mover advantage isn’t enough to stay ahead Marijuana Business Daily points to the September 13th filing for protection from creditors by California-based Plus Products (CSE: PLUS; OTCQX: PLPRF). This was done under the Companies’ Creditors Arrangement Act in Canada. Bankruptcy protection is, of course, not available to U.S. companies dealing in Federally illegal substances. Lessons Learned from Cannabis Stock Trading

In reporting on why first-mover advantage isn’t enough to stay ahead Marijuana Business Daily points to the September 13th filing for protection from creditors by California-based Plus Products (CSE: PLUS; OTCQX: PLPRF). This was done under the Companies’ Creditors Arrangement Act in Canada. Bankruptcy protection is, of course, not available to U.S. companies dealing in Federally illegal substances. Lessons Learned from Cannabis Stock Trading

As the initial entry in the edibles market in California Plus had three of the top 10 selling SKUs. The management team was experienced and well respected leading the company to pursue a well-calculated “asset light” strategy in such a volatile, rapidly evolving market. And, as intensified during the height of the pandemic, edibles became a more discrete method of marijuana consumption. (Edibles, FYI, are projected by Zion Market Research to generate around $11.564 billion by 2025 in the global marketplace, A CAGR of 25% between now and 2025.)

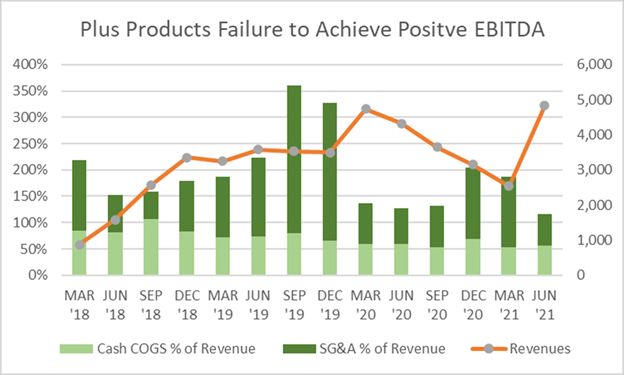

What went wrong, however, is that competition entered the scene to displace Plus products on dispensary shelves. Increasing competition began to show the seams in the company’s business model, a small independent brand selling though independent distributors. This resulted in a 46% decline in sales March 2020 through March this year, the orange line in the graph below.

The result, according to Marijuana Business Daily:

The convertible notes and warrants financing structure used by Plus (and many other early market participants) had a relatively low conversion premium of 16%, which at the time was thought of as a delayed equity issuance. But the cannabis stock crash of 2020 reduced Plus’ stock price to less than 1 Canadian dollar, and it never recovered to the CA$6.50 conversion price.

The key next steps Plus did to begin their recovery was to move to self-distribution and reached an agreement with note holders that, though costly, increased interest on bonds from 8 to 12%, and extended the maturity dates of the convertible notes from Feb. 28, 2021, to Feb. 28, 2024, thereby preventing the specter of a liquidity crisis. This also required issuing $499 of warrants per bond as a fee. Each warrant was convertible at $1.10

What can we learn from the experience of Plus?

- The “asset light” strategy that appeared smart in the beginning actually ended up leaving Plus with a balance sheet inhibiting other capital raising options by showing little significant collateral.

- Plus lacked the critical advantage of scale. Being a smaller independent brand Plus had difficulty holding on to shelf space.

- And, as MJBiz puts it:

Liquidity issues rarely resolve themselves, and aggressive early action, although painful, is the best strategy. Raise capital when it is available rather than when it is desirable.

FYI, you may have heard the announcement that J.P. Morgan sent to its clients that: “J.P. Morgan has introduced a framework that is designed to comply with U.S. money laundering laws and regulations restricting certain activities in securities of U.S. Marijuana Related Businesses.” The restrictions apply to companies with U.S. operations that are not listed on the Nasdaq, the New York Stock Exchange or the Toronto Stock Exchange and have a “direct nexus to marijuana-related activities.” As of Nov. 8, the bank will not allow new purchases or short positions in the related businesses, but clients with existing positions will be allowed to liquidate them.

We’ll keep following this development for ensuing ramifications.

Sorting Through the Right Investment to Meet Your Portfolio Strategy

As for lessons learned, to help our clients assess cannabis investment opportunities based on learning from the publicly traded companies we base our advice on getting back to the fundamentals of the deal. In M&A transactions, for example, here is a summary of steps we guide our clients through:

- Know what the organization is getting into – Detailed due diligence and proper integration planning are core to identifying potential issues. What is the long term plan. This particularly significant in the cannabis industry, since bankruptcy is not allowed for cannabis businesses.

- Get the right people involved– Determine essential stakeholders early and get them involved. By doing so, retention and change issues will be minimized.

- Know what the organization wants out of the deal– Determine objective business decision criteria to minimize political issues and the impact of personal preferences.

- Get it done right – Devote the necessary resources even if the company is “running lean.” Transaction execution and integration are together a full-time job.

- Know what success means– Establish a performance milestones measurement process to measure the success of integration activities.

- Don’t underestimate the infrastructure– The IT function must be an integral part of both the due diligence and integration planning efforts. IT is a critical enabler of all integration efforts.

- Time Kills Deals – so your advisors, lawyers, accountants and other stakeholders must realize that the price and terms of a deal don’t get better over time and negotiation exhaustion kills deals.

- The Only Thing Constant is Change – Target markets and target consumers change rapidly over time. Fingers must be kept on the pulse of the marketplace for the intended goods and services of the merger so that expectations from the beginning of the process remain attainable at close.

- Over-communicate– Personnel will be forgiving at first and will not expect all the answers. They will, however, expect strong leadership that has a vision and a plan for how to get there, how to blend the cultures of the merging organizations into a compatible, inclusive growth-oriented environment.

Investor Takeaway

We know all the indicators point to the explosive growth of the cannabis industry. Statistics from StockDetect.com, for example, tell us that global cannabis sales this year will likely reach nearly $31 billion, an increase of around 41% over 2020. Crunchbase tells us that the average investment size of deals in the cannabis industry this year are already up 165% over 2020. Worldwide, 126 cannabis companies are traded on public exchanges. Yet, cannabis stocks have been on a wild rollercoaster ride with bubble bursts and crashes in 2018, 2019 and low points are still being incurred today. So, what can be learned from the public markets for cannabis stock that can guide strategic investment decision in cannabis companies? Overpriced stocks sooner or later crash. And, fundamentals, guided by experienced industry advisors, overcome emotional investment decisions, especially in the highly volatile cannabis industry.

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to provide access to capital while meeting client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis along with other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments ranging from $5M to $100M+.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.