Consolidation – the Watchword for 2021 Assessing the Right M&A Strategy Post COVID-19

The growth of M&A in 2021 is projected to outpace the growth of the rebuilding economy. In fact, sources such as PwC predict M&A will lead the economic recovery. The M&A recovery actually began in the second half of 2020, so that through November over 13,000 U.S. deals had taken place. This was only slightly behind the pace set in 2019.

This heightened level of activity was the case for the cannabis industry as well. Coming off the mid-year lull, more than $600 million in M&A transactions were announced in Q4 2020. It has been estimated that coming into 2021 there is a backlog of nearly $2 billion in deals pending. With cannabis products sales boosted during the pandemic, a Presidential Administration in place that campaigned on cannabis reform, and election results opening up five new states to legal cannabis use, analysts are predicting that the U.S. cannabis market is likely to double in size by 2025. The pace of this growth in 2021 is expected to be led by those multi-state operators (MSOs) who are now acting more like CPG companies in the maturing cannabis market. They’ve cleaned up their finances as well as their operating procedures, trimmed under performing entities, and have accumulated dry powder for acquisitions aimed at distressed assets in the market that still have value for growth potential.

Strategic M&A

An Accenture analysis of Capital Q data 2020, found that firms making acquisitions in a downturn are likely to yield a higher TSR over a three-year span than the S&P average for the sector in which they compete. That is, a 22% increase from M&A during economic downturns. But, even more pertinent to current circumstances, a 30% increase from M&A during epidemics. Any way it is calculated, M&A in down periods in the economic cycle are vitally important for recovery and growth.

The prediction is for an avalanche of consolidation in the cannabis industry in 2021, comes with the expectation that after the go-go, land-grab early years, M&A will now focus on synergistic acquisitions more strategically designed to increase sales and market share in expanded marketplaces.

And, the consolidation has already begun:

- Two leading Canadian cannabis companies, Aphria and Tilray, announced plans in mid-December for a $4 billion “reverse acquisition.” Once completed this year the merger will create the largest company by revenue in the cannabis industry. As predicted, this merger accelerated the pace of other acquisitions in the industry as other large operators are seeking deals to remain competitive.

- Also included at the end of 2020 were acquisitions by Jushi Holdings, Trulieve and Ayr Strategies in Pennsylvania, Ary also making acquisitions in Ohio and Arizona, TerrAscend with a Maryland acquisition and Verano Holdings acquiring the Arizona and Florida MSO, Altmed.

- Then, on January 14, Canopy growth announced its filing of an early warning report regarding maintaining an option for a 20% pro rata ownership interest in TerrAscend. This is contingent on amendments to or changes in the Federal regulations on cannabis in the U.S.

- On the same date, Cresco Labs, the large MSO, announced its expansion into Florida by the acquisition of Bluma Wellness, Inc. Cresco will now have operations in 7 of the 10 most populated states.

- GrowGeneration acquired Washington-based Indoor Garden and Lighting for expansion in the Pacific Northwest, and acquired Main-based Grow Depot, bringing the total number of GrowGen locations across the U.S. to 42.

- In California, due to close this month is the merger between Caliva and Left Coast Ventures into the Subversive Capital Acquisition SPAC.

- And, to launch its “Green Wave of Acceptance” strategy, on the heels of several acquisitions last year, Curaleaf tendered an offering on the CSE for US $200M. That offering quickly became oversubscribed, grossing Curaleaf US $251M.

What’s Driving this M&A Action

Certainly, the final election results are having a strong affect on deal decisions. There is, of course, a flurry of Executive Orders coming out of the Oval Office and new laws and regulations promised on taxes, trade, healthcare and the environment are being pursued. This extends to cannabis legislation where more progress is anticipated within the next two years – prior to mid-term elections, November 2022. Assessing the Right M&A Strategy Post COVID-19

Last December the house passed the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act which would remove cannabis from being a Schedule 1 controlled substance and enact a variety of social and criminal justice reforms. That legislation now has a better chance of advancing through the Senate to the President. A second piece of legislation critical to the future of cannabis industry in the U.S. is the Secure and Fair Enforcement (SAFE) Act. This Act also passed by the House last year would enable Federally Insured banks to accept deposits from legitimate cannabis and hemp-related businesses.

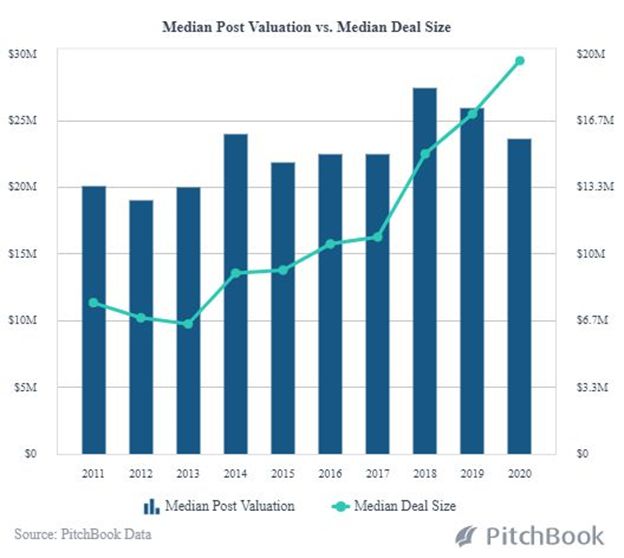

And, these developments have brought a new sense of urgency to the industry that is quickly bringing enterprise market valuations more accurately in line with the more realistic value of cannabis businesses – grounded in actual financial performance. Assessing the Right M&A Strategy Post COVID-19

Sorting Out the Winners

From a 2010 study in the Harvard Business Review, Accenture reports that 17% of public companies don’t survive a global downturn. It is critical, then, to look at prospective deals that identify operational efficiencies and performance objectives that validate the focus of the company in an M&A transaction. To help investors identify, consummate and integrate M&A deals successfully, here are several points we help them cover:

- Identify critical risk points – operational and performance gaps that indicate organizational weaknesses. The investor or the target company must be prepared that this scrutiny is likely to impact faults that are found with existing alliances, in internal departments that are under-performing, and in measures needed to prevent hostile takeovers.

- When looking at distressed assets, have a clear idea of what the strategy and expectations are to strengthen their value.

- Project If/when the company will be in a position to tap lines of credit or borrow at a low rate; thereby enabling the company to have capital available for additional strategic investment.

- If M&A is on the agenda, enlist advisory services NOW in order to insure diligence efforts are in place to quickly pursue tight windows of opportunity.

- Build a broader strategy than may be being pursued at present in order to be resilient in the face of volatile, evolving business conditions.

- For instance, clarify purpose and inclusion, environmental, social, governance (ESG) policies which will affect an organization’s success and value as companies are becoming more accountable than ever to shareholders and the public on these issues.

- Overall, look for the opportunities that have most effectively embraced the affect digitalization will have on their business model, and have employed analytics to resolve potential risks, sorting out financial and operational weaknesses.

Preparing a Successful Acquisition Target

On the other side of the coin, among the factors we help with to prepare a company to be an attractive target for acquisition, we work with operators on these critical issues:

- Substantiate the existing/proposed path toward liquidity, with risk mitigation planning and bridging any gaps throughout the value chain.

- Prepare the business now since all MSOs on the hunt will want to move quickly on the most solid opportunities.

- Have a clearly defined cap table.

- Clear up as much debt, taxes, legal matters as possible.

- Specify all corporate governance-related policies.

- And, substantiate a valuation based carefully on results, or readily achievable EBITDA.

Investor Takeaway

In any industry, M&A in down periods is an important mechanism for recovery, likely to be even more so as our economy charges out from under the restrictions imposed as a result of the pandemic. All indications are that the M&A recovery, particularly in the cannabis industry, that began in late 2020 will accelerate in 2021. Investors in M&A targets in cannabis will have a broad choice of businesses ranging from those fallen into distress during the pandemic to those unprepared for the most successful exit strategy. We cited the finding that 17% of public companies don’t survive a global downturn. So, businesses are advised to begin the necessary pipeline and diligence efforts now to be ready for consolidation opportunities where the window of opportunity can close quickly; when the highest returns have been shown to occur when M&A transactions happen as a result of economic downturns. Assessing the Right M&A Strategy Post COVID-19

How We Can Help

At Highway 33 Capital Advisory we excel at structuring deals to meet client investment strategies in emerging 2021 opportunities with our core expertise in Cannabis and other highly regulated markets in the fields of Pharma, Biotech, Healthcare, Agtech, Clean/ClimateTech, and CBD/hemp companies. We specialize in thoroughly vetted companies looking to drive growth and enterprise valuations through M&A, non-dilutive debt financing and/or capital investments.

Let’s talk about putting the power of this expertise to work for you as a Sell or Buy-side client.